Top Market Takeaways Bull or bear - How do you see the market?

Never forget.

Twenty years later, we remember the thousands of innocent people lost in the 9/11 attacks. We thank the first responders who risked their own lives to save as many others’ as they could, and we honor the friends, family, and colleagues of the victims and the brave. We’ll never forget.

Market Update: Half empty or half full?

Investors seem to be languishing. The S&P 500 has lost -0.7% since the start of September, while sector and style performance has teeter-tottered day by day. Treasury yields across the curve are about the same as they were a week ago, and the latest American Association of Individual Investors (AAII) Investor Sentiment Survey1 showed the biggest jump in the number of investors with an “indifferent” attitude (i.e., not bullish or bearish) since the summer of 2018.

When you look at the investment environment today, do you see the glass as half empty or half full?

On one hand, the delta variant drag is increasingly apparent in economic data (e.g., last Friday’s jobs report). That’s prompted a wave of downgrades to 2021 growth forecasts across Wall Street, and a less-than-cheerful tone in the Fed’s latest economic conditions report. It doesn’t change the reality that peak policy support has passed: federal supplements to unemployment benefits and eviction protections in the U.S. expired this week, Fed officials are staying on script about impending tapering and the European Central Bank (ECB) announced yesterday that it’ll likewise start reducing the pace of its own asset purchases.

On the other hand, the U.S. virus case count curve is plateauing. Consumers still have trillions of dollars in excess savings that can help fuel future spending, and there are 1.26 job openings for every unemployed individual in the United States. Congress is negotiating an infrastructure deal, and we think it’s likely that a package of at least $1.5 trillion gets passed before year-end. As for monetary policy, the pace of asset purchases isn’t stopping (it will be a gradual transition from a fire hose, to a garden hose, to a bathroom sink…), and rate hikes are still a ways away. Corporations are finding ways to increase productivity, boosting profit margins even as input costs rise. That bodes well for a continuation of strong earnings growth for quarters to come.

Consider us in the “glass half full” camp. COVID-19, inflation, and growth slowdown worries will probably persist at least through year-end, but we don’t think they’ll manifest as strong enough headwinds to derail the powerful momentum of robust demand, still-easy financial conditions, and the corporate earnings growth spurt.

Importantly, though, we’re not Pollyannaish. There are certain areas of the market we’re urging investors to move away from, including but not limited to excess cash, long duration fixed income, and stocks of unprofitable companies.

So, what are we excited about? In equities, we see compelling opportunities in both cyclical and growth stocks. Cyclicals could benefit from a revival of normalization and pent-up demand as we get over the delta variant hump, and growth segments could get a boost as the market seeks out companies that can beat the broad market earnings growth rate as the boom moderates into a more sustainable cruising speed.

Across both cyclicals and growth, there are two specific things we’re looking for: reasonable valuation entry points to get exposure to strong earnings growth in the year ahead, and high-quality businesses.

Spotlight: Finding growth at a reasonable price and quality

Here’s an overview of our framework for identifying what we deem to be the best opportunities in the equity landscape right now.

Growth, but at a reasonable price.

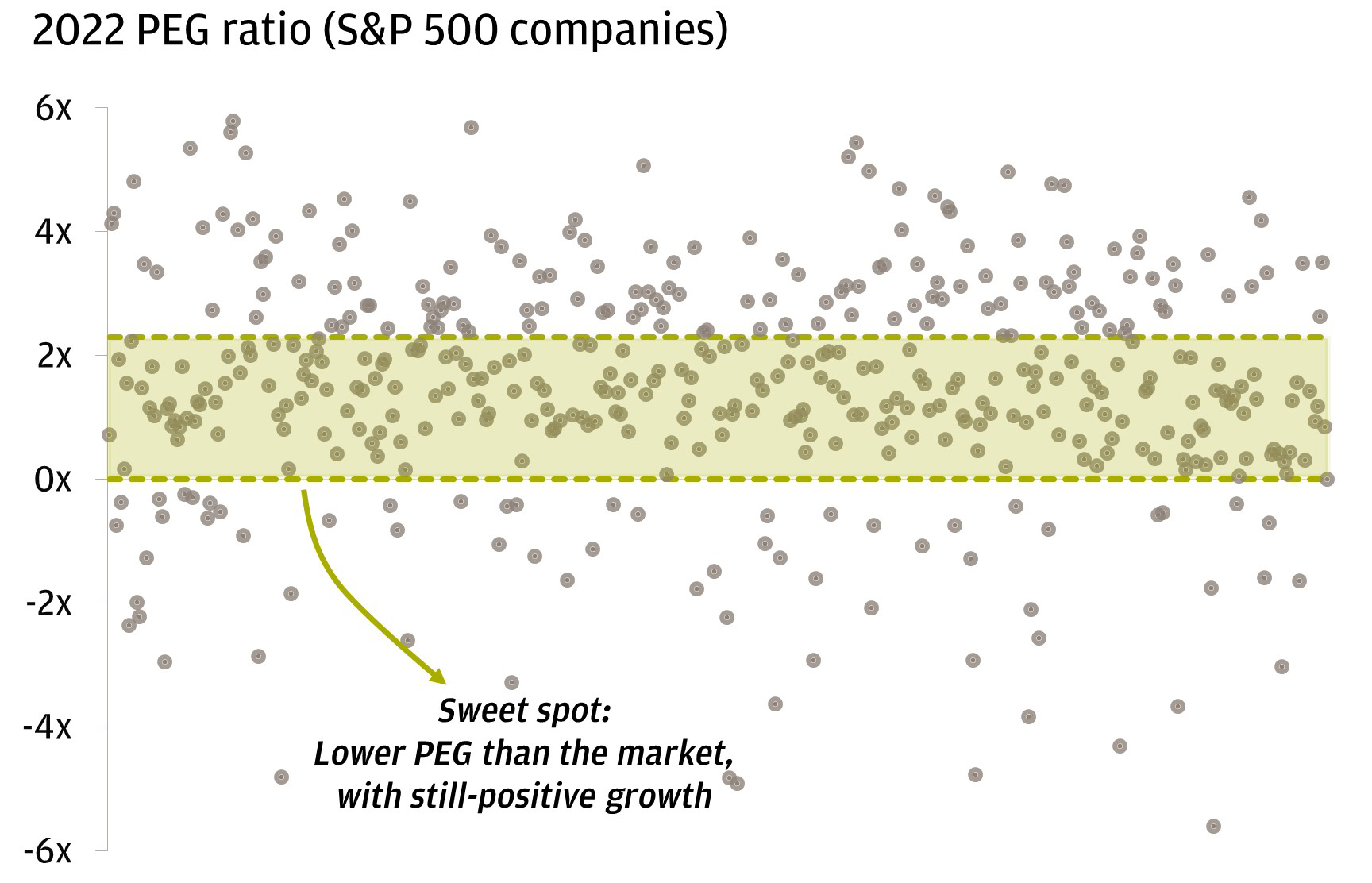

Equity valuations are high relative to their own history, there’s no denying that – the S&P 500 is trading at a valuation of 21.2x 2022 earnings. But investors should consider what they’re paying for. Consensus expects earnings to grow ~9% year-over-year in 2022. If we pair valuations with earnings growth expectations by calculating a price to earnings to growth (PEG) ratio, we get a better sense of which pockets of the market might offer the best bang for your buck. Right now, the broad market’s PEG ratio is at 2.3x.

So, we want to isolate the opportunities with a PEG ratio lower than 2.3x but above 0 (because a negative figure would suggest that the market is expecting negative earnings growth).

Finding growth opportunities more reasonably priced than the broad market

Quality, and how we measure it.

We like growth and we like a good deal, but quality is essential: As we move into the mid-cycle environment, history tells us that outperformance shifts away from companies that were disproportionately punished throughout a recession because they were deemed to be less financially sound, and towards companies with strong balance sheets and management.

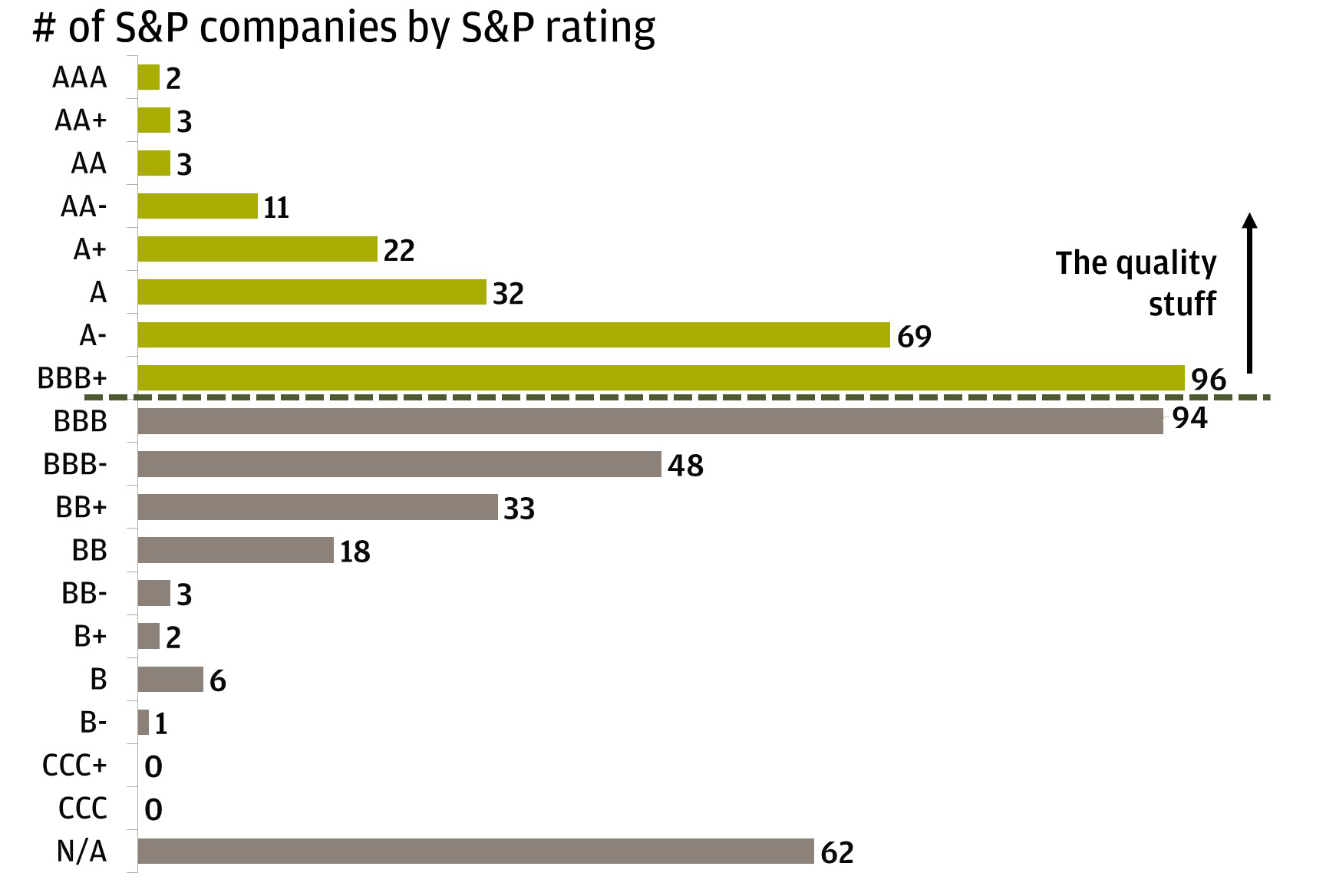

We usually focus on credit ratings when we’re thinking about bonds. But they are helpful gauges of a company’s overall financial health, so they’re also useful in gauging risks in specific stocks as well.

As such, an equity investor focused on “quality” probably doesn’t want to go anywhere near a company with (or close to) a “junk” rating. As far as S&P is concerned, anything with a rating of BB+ or below falls in the junk bin. Right now, we prefer to stick with those that are at least BBB+ or higher.

Credit ratings help sift out quality: focus on BBB+ and better

We can take the “quality” screen one step further by considering ESG ratings, which MSCI actually defines as a “measure of a company’s resilience to long-term, industry material environmental, social, and governance (ESG) risks.” We’ve noted before that ESG leaders often stay more competitive than their peers because they’re good at allocating resources, managing their workforces, and diligently overseeing their supply chains. Similar to a credit rating scale, MSCI doles out ESG grades on a scale of AAA to CCC. To make our cut, they have to get a grade of B or higher.

The bottom line.

There are pockets of the market that trade at attractive growth-adjusted valuations that are also financially healthful and relatively insulated to broader societal and reputational risks. They’re not isolated to one sector or style – we’re keen on balancing exposure to cyclical and growth segments, which lends itself to a well-diversified portfolio built to navigate the evolution from recovery to expansion.

All market data from Bloomberg Finance L.P., 9/9/21.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Elyse Ausenbaugh

Head of Investment Strategy, J.P. Morgan Wealth Management

Head of Investment Strategy, J.P. Morgan Wealth Management

Elyse Ausenbaugh is a member of the Client Advice and Strategy team at J.P. Morgan, which includes J.P. Morgan Private Bank and J.P. Morgan Wealth Management. In this role, Elyse, in partnership with asset class leaders and the Chief Inv ...More

Footnotes

-

1

American Association of Individual Investors (AAII) Investor Sentiment Survey, as of September 8, 2021.