Top Market Takeaways Quick shot: Maintain the mindset

This week in Quick Shot we have discussed the recent swings in yields, volatility in stocks and where we see opportunity.

Let’s review. The S&P 500 has officially suffered a pullback with the index down approximately 7.6% since the start of August. This appears to be thanks to the rapid surge in bond yields with the 10-year U.S. Treasury yield hitting 4.8% on October 3. For stocks, the silver lining is that by taking a breather after such a steep climb, stock market valuations have become more reasonable as some of the froth has been removed from the market. As for fixed income, we believe today’s environment presents a potential opportunity to lock in elevated yields in high quality core bonds.

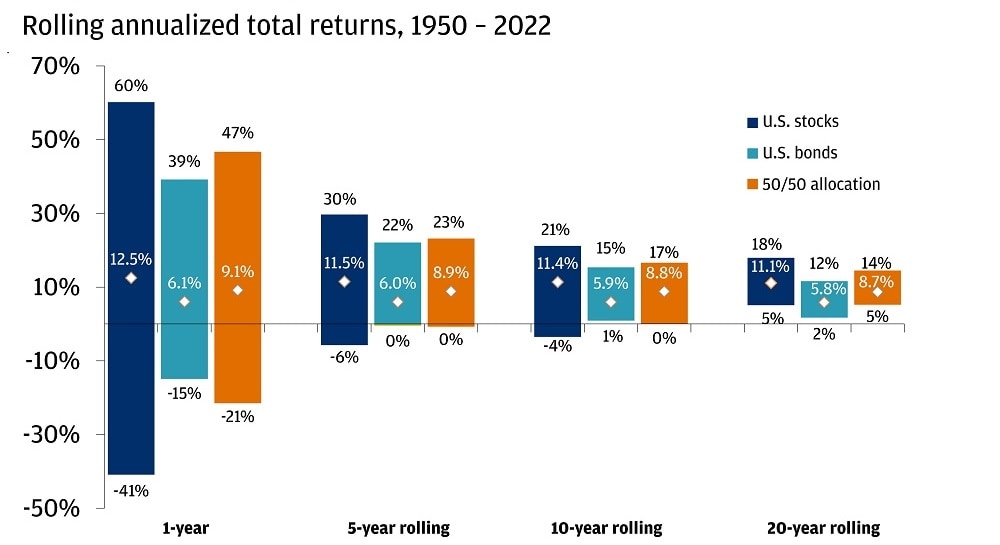

The recent market environment is a prime example that over the short term, different assets have a wide range of possible outcomes. That said, we believe that over the long term, the possibilities can be much more certain. So while a bad day, week, month or even year are in the cards for markets, history suggests investors are less likely to suffer losses over longer periods – especially in a diversified portfolio.

While rolling 12-month stock returns have varied widely since 1950 (+60% to -41%), a blend of stocks and bonds has not suffered an annualized negative return over any five-year rolling period over the past 70 years. Remember, past performance doesn’t promise future results, but that’s a compelling track record.

Note that every investor’s portfolio will look different depending on their unique set of financial goals, ability and willingness to take risk, and time horizon. As always, it is key to keep your goals and your plan top of mind.

Range of stock, bond, and blended total returns

Past performance is no guarantee of future results. It is not possible to invest directly in an index.

All market data from Bloomberg Finance L.P., 10/5/23.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Global Investment Strategy Team

J.P. Morgan Wealth Management

J.P. Morgan Wealth Management

The Global Investment Strategy group provides insights and investment advice to help our clients achieve their long-term goals. They draw on the extensive knowledge and experience of the group’s economists, investment strategists and ass ...More