Top Market Takeaways Quick shot: A guiding light

A common myth is that two consecutive quarters of negative gross domestic product (GDP) mean the U.S. economy is in a recession. However, the National Bureau of Economic Research’s definition emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months. An excellent example is the pandemic-induced 2020 recession which lasted just three months.

We bring this up because many investors appear to be divided on whether the U.S. economy will experience a recession in 2024. We are leaning toward the “no recession” camp, but acknowledge that a recession remains possible. So how will investors know whether a recession is indeed coming or not?

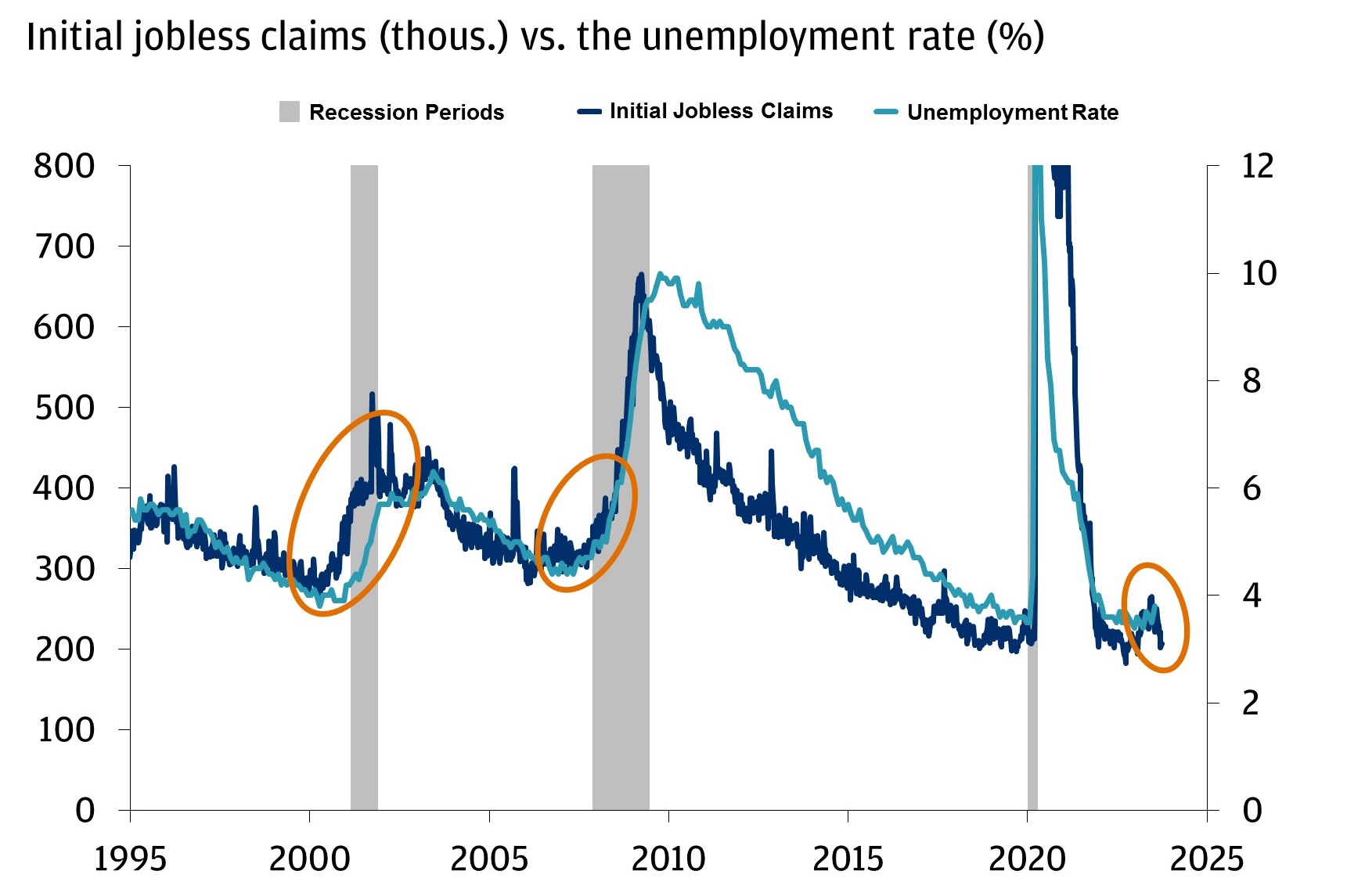

There are a number of leading indicators like the yield curve, which is getting a lot of attention right now due to surging bond yields, but we think investors should watch a metric that is less open to interpretation called initial jobless claims. In our opinion, it will be the guiding light moving forward as it tends to foreshadow a move higher in the U.S. unemployment rate. For those unfamiliar, initial jobless claims are released every Thursday at 8:30am and are weekly tallies of how many people filed for unemployment insurance during that week. Not only are the data timely, but they are typically very accurate depictions of labor market conditions.

Currently, jobless claims have been declining since mid-June and stand at just 207,000 claims. Rather than signaling a recession, claims data appear to be suggesting an economic acceleration in the third quarter, which would be consistent with popular GDP trackers like the Atlanta Fed GDPNowcast. The September employment report supports this as well with the economy adding 336,000 jobs in September and the three-month moving average coming in at 266,000 jobs – well above the pace needed to keep the unemployment rate from rising. That said, an economy that is stronger-for-longer likely means higher-for-longer for intertest rates. The risk of higher rates becoming even more restrictive for the economy remains notable. However, unless we see a steady climb in weekly jobless claims to something north of 275,000, we think it’s premature to claim that a recession is a pre-ordained outcome.

Timely claims data are not signaling an imminent recession

All market data from Bloomberg Finance L.P., 10/6/23.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.