Top Market Takeaways Quick shot: Stock market history says, Happy Thanksgiving!

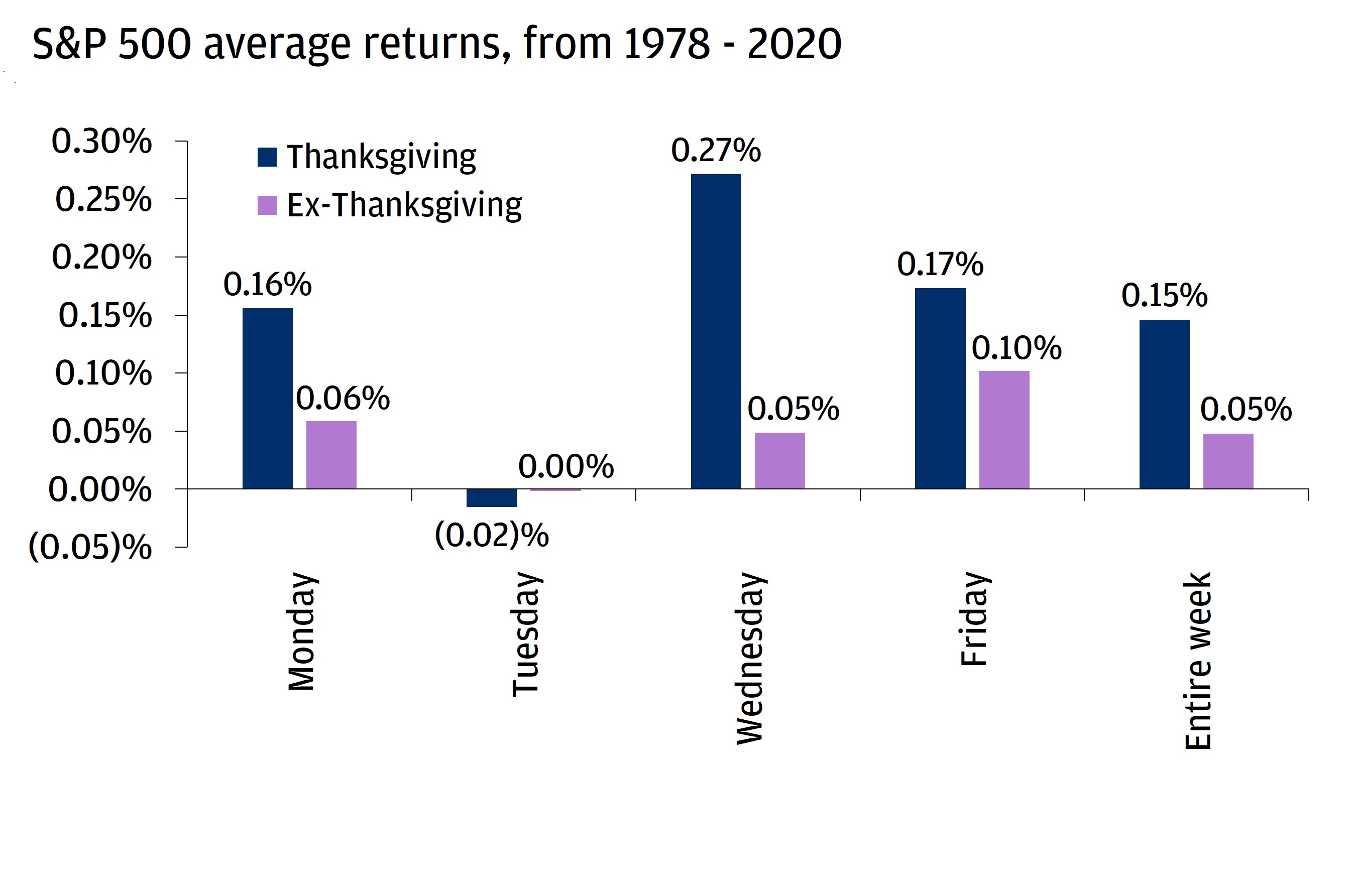

We all have things to be thankful for, and investors might be grateful for how the stock market tends to behave around turkey day. Since 1978, the S&P 500 average return for Thanksgiving week has outperformed the average return of every other week.

Over the past 42 years, Thanksgiving week has brought positive stock market returns around 67% of the time. As consumers gear up for Black Friday and the general holiday shopping season, personal consumption tends to get a boost. Strong demand begets revenues for the companies we invest in, and that can lead to earnings growth.

As we’ve discussed before, we expect that earnings growth to continue to push markets higher in the year ahead. Tomorrow may be all about the turkey, but don’t let all the tryptophan cause you to sleep on the opportunity to get (and stay) invested.

STOCK MARKET SHOWS SOLID PERFORMANCE DURING THE THANKSGIVING WEEK

All market data from Bloomberg Finance L.P., 11/23/21.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.