Top Market Takeaways Quick shot: November vital signs.

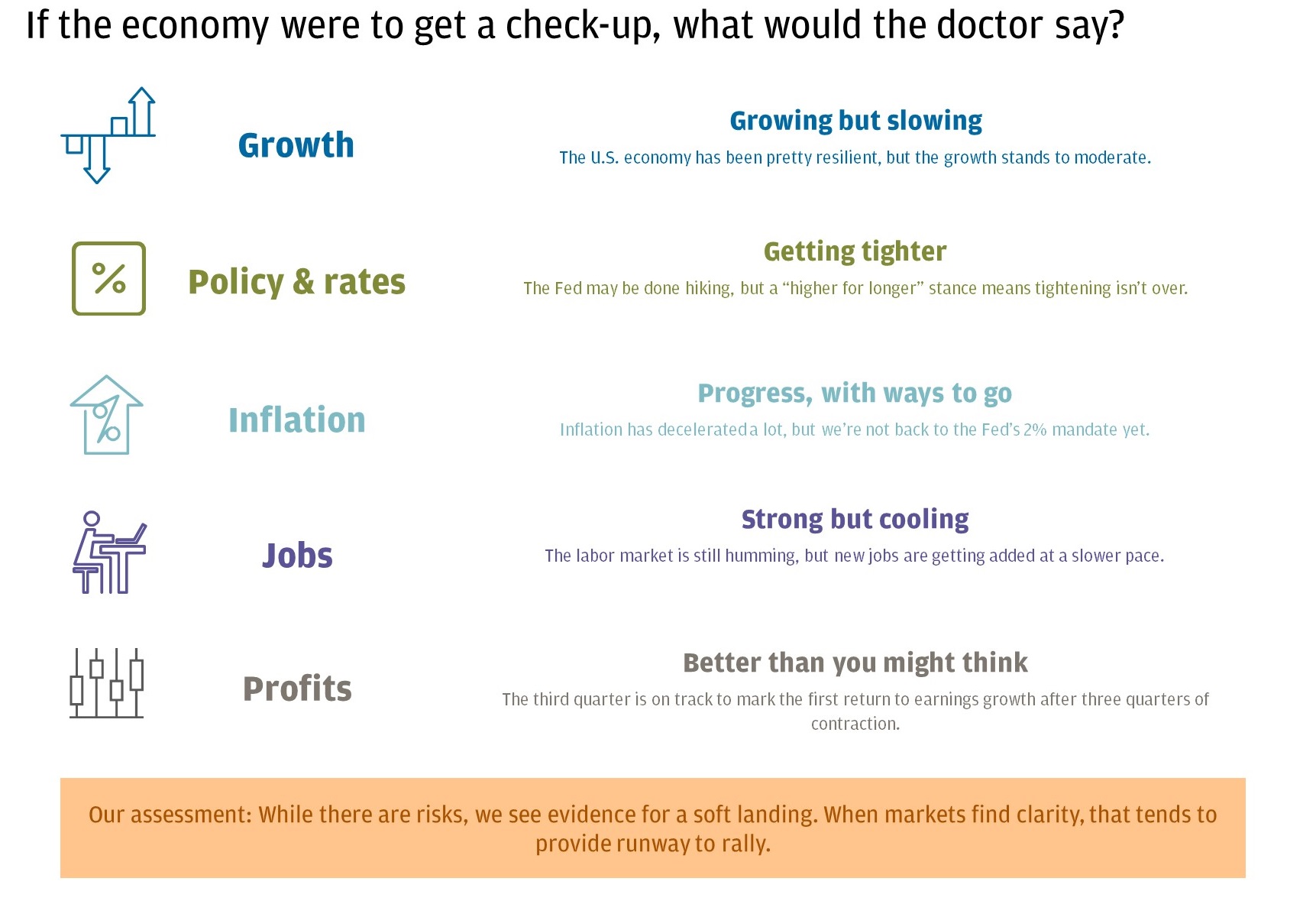

With a little under two months left in 2023, we thought it apt to perform a “checkup” on the markets and the economy. Let’s take a brief look at some of the key economic and market “vital signs”:

Economic growth: The U.S. economy has been pretty resilient, but the growth stands to moderate.

Policy and Rates: The Federal Reserve (Fed) may be done hiking, but a “higher for longer” stance means tightening isn’t over.

Inflation: Inflation has decelerated a lot, but we’re not back to the Fed’s 2% mandate yet.

Labor Market: The labor market is still humming, but new jobs are getting added at a slower pace.

Earnings: Third quarter earnings are on track to mark the first return to earnings growth after three straight quarters of contraction.

The results? The vital signs are on track to finish the year better-than-expected. The path has been paved for a probable soft landing amidst a needed unwind of inflation and the Fed’s policy rate has been deemed to be in restrictive territory.

A recession may not be on the horizon but, as always, there are risks. It is crucial to stick to your plan and keep your goals top of mind.

Macro and market vital signs

All market data from Bloomberg Finance L.P., 11/10/23.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Global Investment Strategy Team

J.P. Morgan Wealth Management

J.P. Morgan Wealth Management

The Global Investment Strategy group provides insights and investment advice to help our clients achieve their long-term goals. They draw on the extensive knowledge and experience of the group’s economists, investment strategists and ass ...More