Top Market Takeaways Quick shot: How Main Street feels tighter Fed policy

There’s a lot of uncertainty plaguing the investments landscape, and the wild market swings of late are emblematic of investors’ apprehension about the path forward. Inflation is still running hot, and the Fed is following a speedy path of rate hikes to try to slow it down. To do so, they need broader economic activity to slow down. As such, they want us all to feel less inclined to borrow money and spend it elsewhere.

That’s why their control over interest rates is so important – higher interest rates make it more expensive to borrow, removing the incentive to do so. Although the Fed has only delivered a couple of rate hikes so far, the market knows more are coming and has moved to price them in. Already, we’re starting to see the effects.

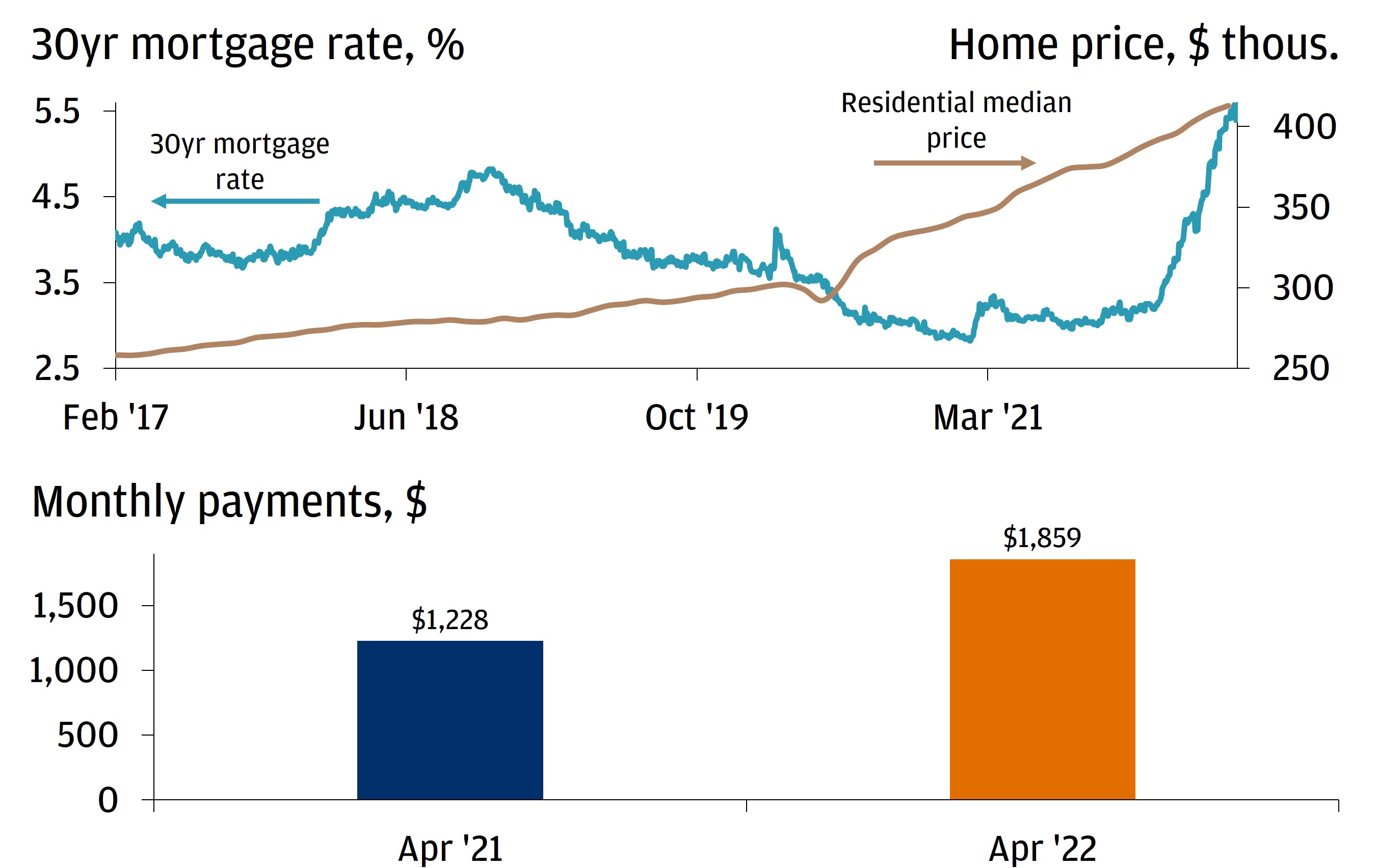

Being very interest rate sensitive, the housing market tends to be one of the first places that the effects of changes in Fed policy start to show up. 30-year fixed mortgage rates have shot higher at one of their fastest paces on record year-to-date. Today, a new 30-year mortgage comes with an interest rate of 5.5%, versus 3.1% one year ago. Combine that with the climb in home prices seen over the past couple of years, and it’s made buying a home much less affordable: The payment on a new 30-year fixed mortgage to buy the typical single family home in America today has increased more than $600 a month versus a year ago!

As a result, it’s no wonder we’re starting to see mortgage application activity soften and overall home sales come down. To us, that’s a sign that the Fed’s policy moves will ultimately have the desired effects of slowing economic growth and inflation in the economy more broadly. The risk is that the Fed overdoes it, and slows growth to the point of recession. That’s not our base case, but we’ll be watching data closely in the next few months for signs that things could be changing.

HIGHER MORTGAGE RATES AND HOME VALUE APPRECIATION HAVE MADE THE COST OF HOME OWNERSHIP RISE MEANINGFULLY

All market data from Bloomberg Finance L.P., 5/23/22.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.