Top Market Takeaways Quick shot: Markets react on the back of hotter-than-anticipated inflation.

Markets were again thwarted by a hotter-than-anticipated U.S. inflation reading. There’s no need to get too much into the weeds here, but (believe it or not) it’s not as hot as headlines initially suggested. It’s still likely we must confront a few more high prints from here (especially as the impacts of war and lockdowns in China filter through the data), but it is starting to seem more likely than not that we are through the worst of the inflation shock.

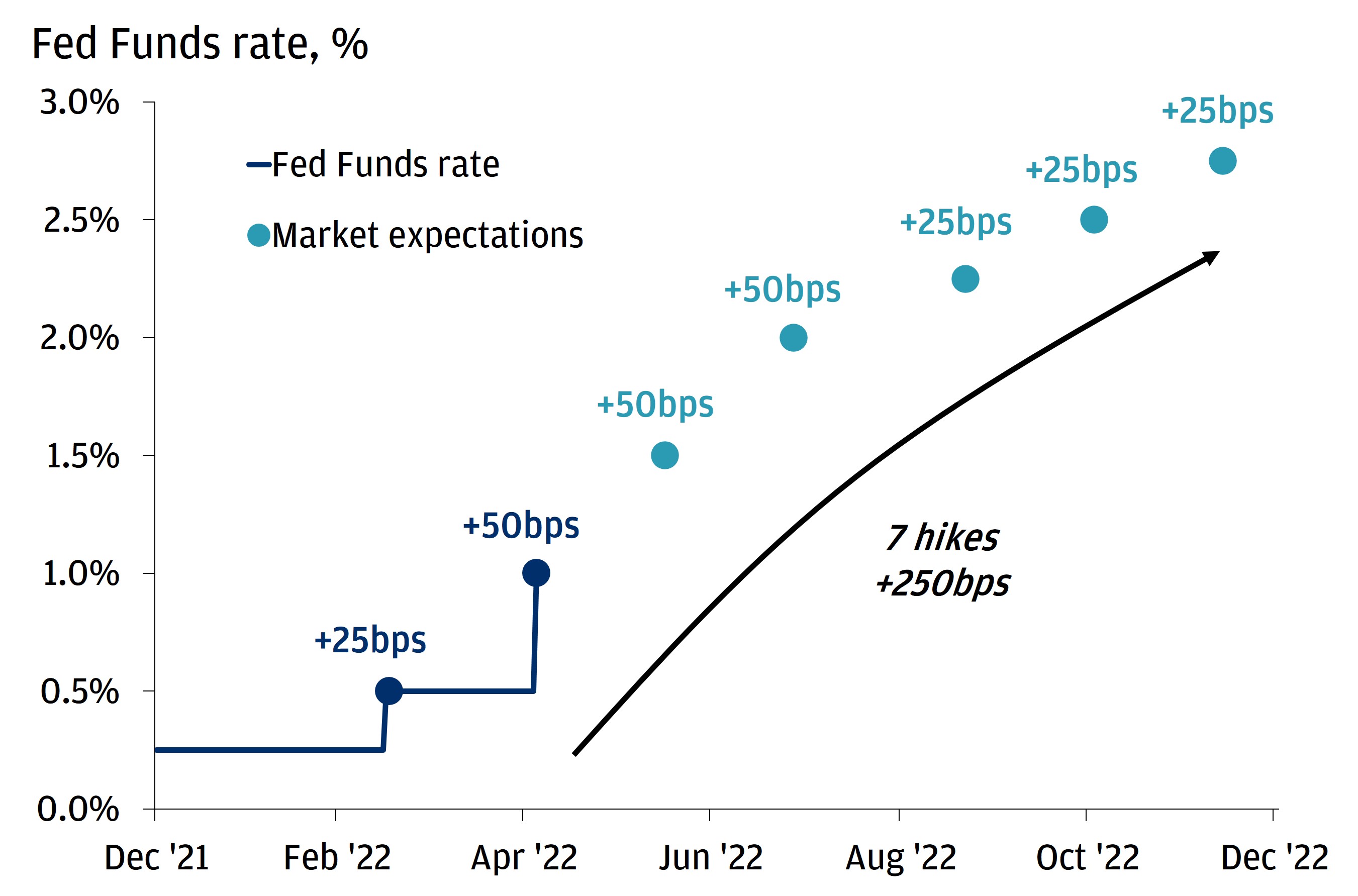

Good or bad, markets reacted accordingly. And, now, it’s pricing five more hikes going forward, including two 50bps hikes – yikes (suggest we remove yikes, only reads negative and savers can benefit). Thus, financial conditions are poised to get tough from here if economic growth slows down. Some signals point out to the slowdown already coming into fruition. For instance, the housing market – the most interest-rate sensitive component of the economy – is the first indicator to show signs. If you walk into a branch today to get a 30-year fixed mortgage (~5.5%), the spread between your rate versus someone with an existing mortgage (~3.4%) is the widest on record.

That said, although recession probabilities have risen and the near-term environment seems uncertain, we believe that the Fed can manage a soft-landing. Said differently, the Fed can achieve the moderate economic slowdown needed to cool down the soaring inflation we’re currently experiencing.

THE MARKET IS PRICING IN AN AGGRESSIVE PATH FOR THE FED THIS YEAR

All market data from Bloomberg Finance L.P., 5/12/22.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.