Top Market Takeaways The race to rate cuts is on: What it means for you

By: Madison Faller and Samuel Zief

It’s happening: Rate cuts are officially here and more are on the way.

That was the resounding message from the flurry of central banks that met this week.

Many have been skeptical, and for good reason: Inflation has felt like the problem that just wouldn’t go away. But with price pressures now abating, and policymakers shifting their focus to the risk of overtightening, times are changing. Markets are taking notice: A global 60/40 stock/bond allocation is having its best week of the year so far.

Is your portfolio ready?

The race to rate cuts is officially on

With a string of hot data – from jobs to inflation – to start the year, doubts were starting to grow that central bankers would deliver rate cuts at all in 2024.

Instead, this week brought an entirely different message from the central bank chorus: The pivot is happening.

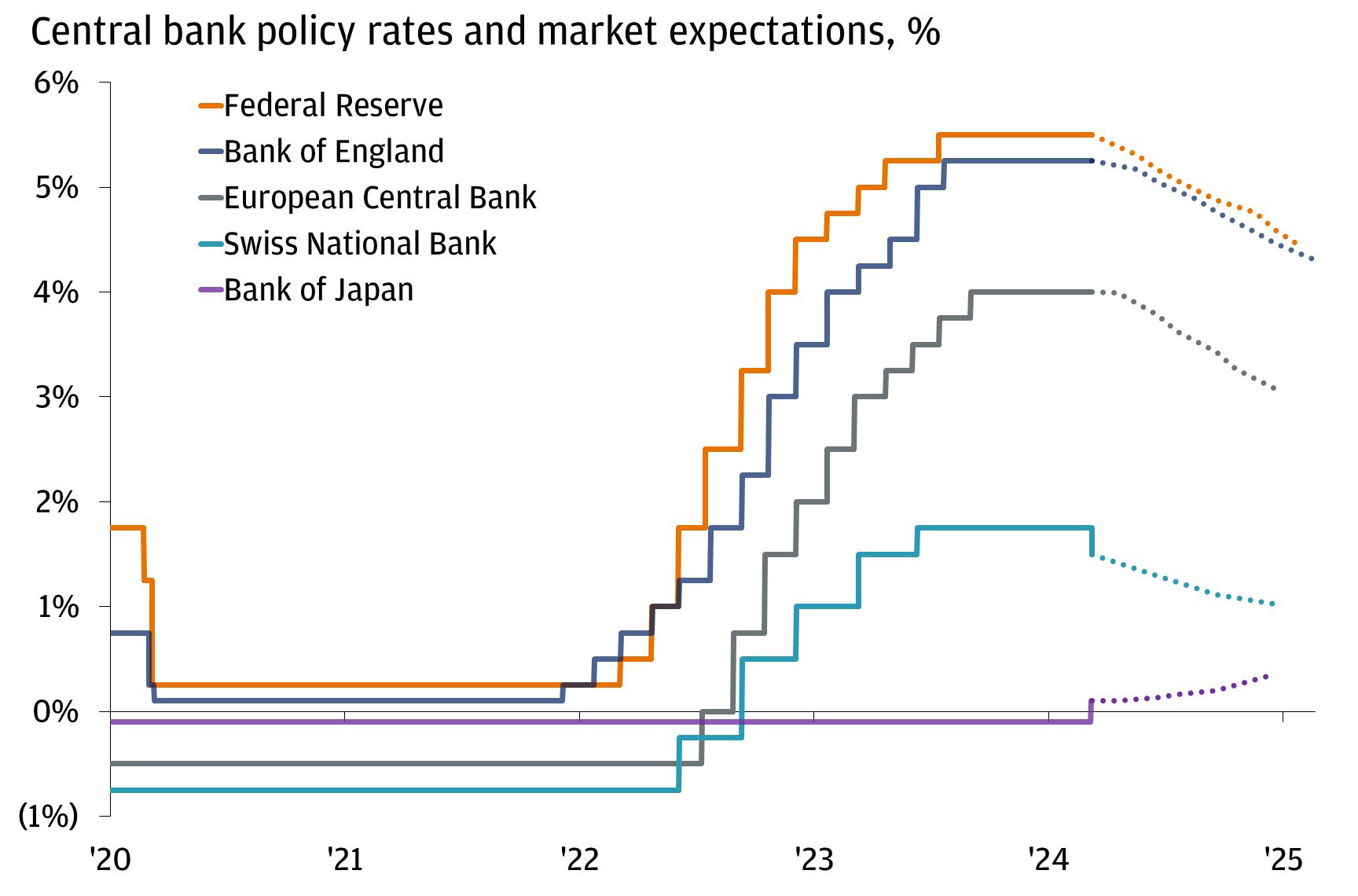

The Swiss National Bank (SNB) made history as the first developed market central bank to deliver a rate cut this cycle. The Federal Reserve confirmed that it still plans to cut rates three times this year, even with stronger growth and stickier inflation in mind. The Bank of England laid the groundwork for a potential cut as soon as June, with the United Kingdom “on the way” to winning its fight against inflation. Even the Bank of Japan made its own milestone, hiking rates for the first time in 17 years to officially put an end to the negative interest rate experiment.

In all, the race to lower rates is officially on – and the SNB just kicked it off.

Off to the races: rate cuts are on the way

Policymakers aren’t as worried about inflation

The task of taming inflation without derailing growth has been a delicate one for central bankers. To make a long story short, policymakers signaled this week that they’re starting to focus more on the downside risks to economic activity from keeping rates high, rather than obsessing about inflation’s bumpy path back to 2% targets.

The Fed gave us a few updates to support this:

- Fed Chair Powell stressed that, just as the central bank didn’t overreact to softer inflation prints last year, it’s not taking firmer readings over the last two months as a new trend either. These are inevitable “bumps in the road” in the disinflation process.

- Powell made one meaningful change in his prepared statement from the January meeting: to add the idea that “an unexpected weakening in the labor market could…warrant a policy response.” While he said he doesn’t think that is likely, it suggests this the Fed is more inclined to cut than it is to hike.

- The Fed signaled a stronger economy, bumping up its GDP growth and inflation projections, while also lowering its unemployment forecast. And yet, it still sees the three rate cuts this year it had before. How? The committee specifically called out “improving supply conditions” (especially in the labor market) as a key reason why stronger growth need not stoke more inflation. This signals that the Fed thinks the economy looks healthy, not too hot, and that rate cuts should remain on the table.

All told, the Fed – along with most of its global peers – seems more inclined to start cutting at the first sign of economic weakness than aggressively hiking if inflation takes a bit longer to return to target. That “asymmetry” in its decision-making is good news for multi-asset class investors.

Reinvestment risk is real: Rethink your cash

With rates higher for longer, investors haven’t felt incentivized to run out of cash. Now, with cuts in motion, those sitting on the sidelines should think about picking it up to a jog.

Consider the paths ahead. Let’s say that we avoid a recession and achieve a “soft landing.” In that scenario, riskier assets such as stocks should outperform. On the flip side, let’s say we do get that recession. Bonds can offer stability and a hedge against downside risks. Or, finally, let’s say inflation reaccelerates. As we saw in 2022, alternatives such as real assets can outperform – as well as offer access to long-term trends such as industrial policy and the energy transition.

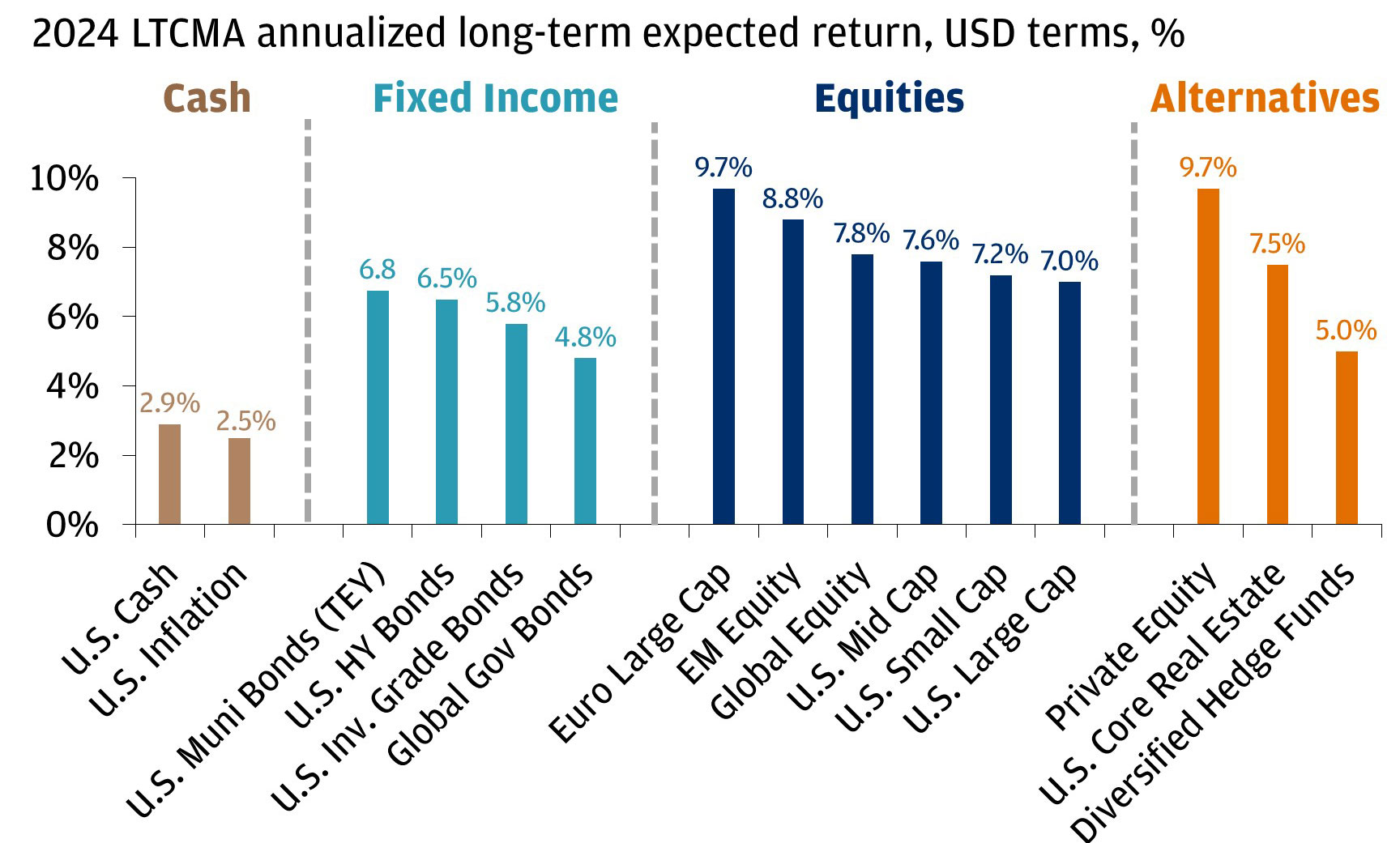

It’s also worth noting that, even in a year like 2023, when cash offered some of the best yields in over a decade, it still underperformed most other asset classes: Rolling T-bills generated a 5.1% return compared to a 26% rally in U.S. stocks and a 8.5% return in U.S. investment grade bonds. As returns compound over time, this can lead to big differences.

So while cash has a purpose, and it can be a critical part of any investor’s plan, we’re reminded now more than ever that it comes with a cost. Just ask a deposit holder this week in Switzerland.

Stocks are marching higher as the rally broadens

Heading into Friday, the S&P 500 has made 20 new all-time highs so far this year. After a long two-year drought, this means 35% of 2024’s trading days have notched a new record. Better growth, moderate inflation and Fed easing are the “chef’s kiss” recipe for corporate profits, and, in turn, broader equity returns.

But as many lamented big tech’s leadership last year, this year is bringing a much broader trend: Year-to-date, over one-third of S&P 500 companies are actually beating the broader index’s 10.3% total return, and almost three-quarters are higher overall on the year.

The stock rally has been broadening out

The rally goes even broader than that. U.S. small and mid-caps have outperformed the S&P 500 since the lull we saw in markets in late October. Thirty-five out of 48 MSCI countries we track are higher on the year – and the United States ranks 14th. This calls to mind that markets in both Japan and Europe have also made their own all-time highs over the last few weeks.

Questions abound over whether sitting on the sidelines means you’ve “missed it.” With the potential for more gains ahead, we think the bigger risk is standing idle.

Bonds stand to up their game in portfolios

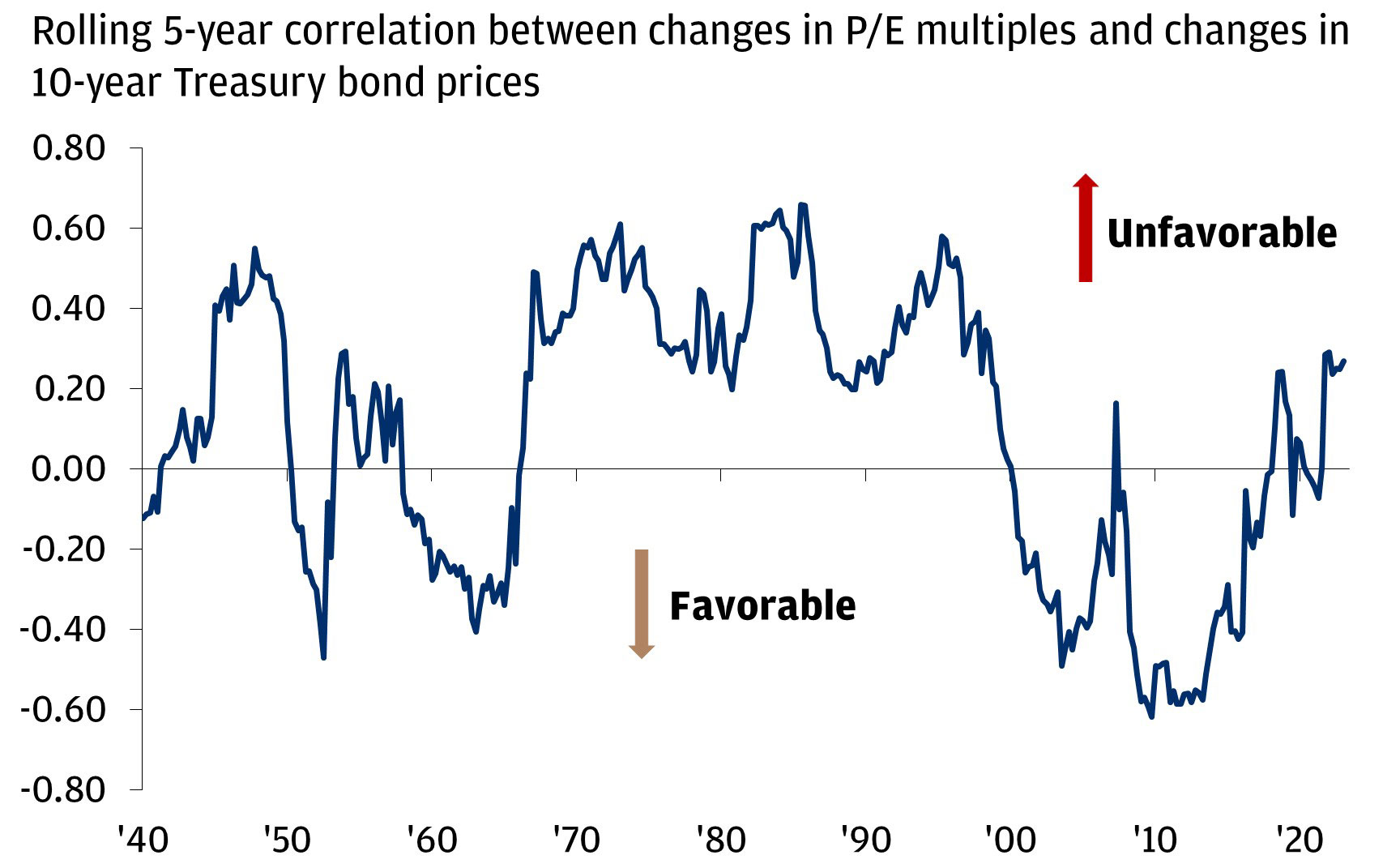

Over the last two years, bonds haven’t provided the diversification we’re used to. This has had a lot to do with inflation running at more than double of central bank targets. If risk assets came under pressure, it was a good chance it was because inflation was accelerating and central banks needed to get more and more aggressive. And with inflation that high, it also makes it really difficult for central banks to cut if they have to.

With inflation now steadily moving lower, we see bonds playing a renewed role in portfolios. Based on our analysis, we think inflation below 3% will likely enable the return of a favorable negative stock-bond correlation. At this point, central banks tend to be less constrained in their ability to respond to any negative economic or market shock, and the general public and market participants don’t typically see inflation as much as a problem.

After 20 years of a favorable stock-bond correlation, it flipped during the recent inflation shock

In our view, this strengthens the potential for portfolio diversification. Surveying the fixed income landscape today, we see tactical opportunity on the shorter-end of the curve (think: 2–3 years) as central banks kick off rate cuts, while we also continue to see strategic opportunity in longer duration for many investors that still need to right-size their portfolios.

Keep your goals top of mind

Cash comes with an opportunity cost. Take this week’s news as a sign to step back. Think again about how much liquidity you really need and how that fits into your long-term goals.

We think the tailwinds for a ripe investing landscape remain in place: Growth is resilient, disinflation is still on trend, earnings are growing and AI enthusiasm continues on. In our view, this continues to open up opportunities across asset classes, in both the short and long terms. Consider J.P. Morgan Asset Management’s Long Term Capital Market Assumptions, which scrutinize over 200 asset and strategy classes to provide return outlooks over a 10- to 15-year investment horizon. The punchline: Cash rates may be high today, but every major asset class stands to outperform cash over that investment horizon.

We see compelling opportunities outside of cash

Your J.P. Morgan team can help you reassess how much cash you need and where excess capital might be deployed to reach your family’s goals.

All market and economic data as of 03/22/2024 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.