Top Market Takeaways Quick shot: The energy market is under pressure

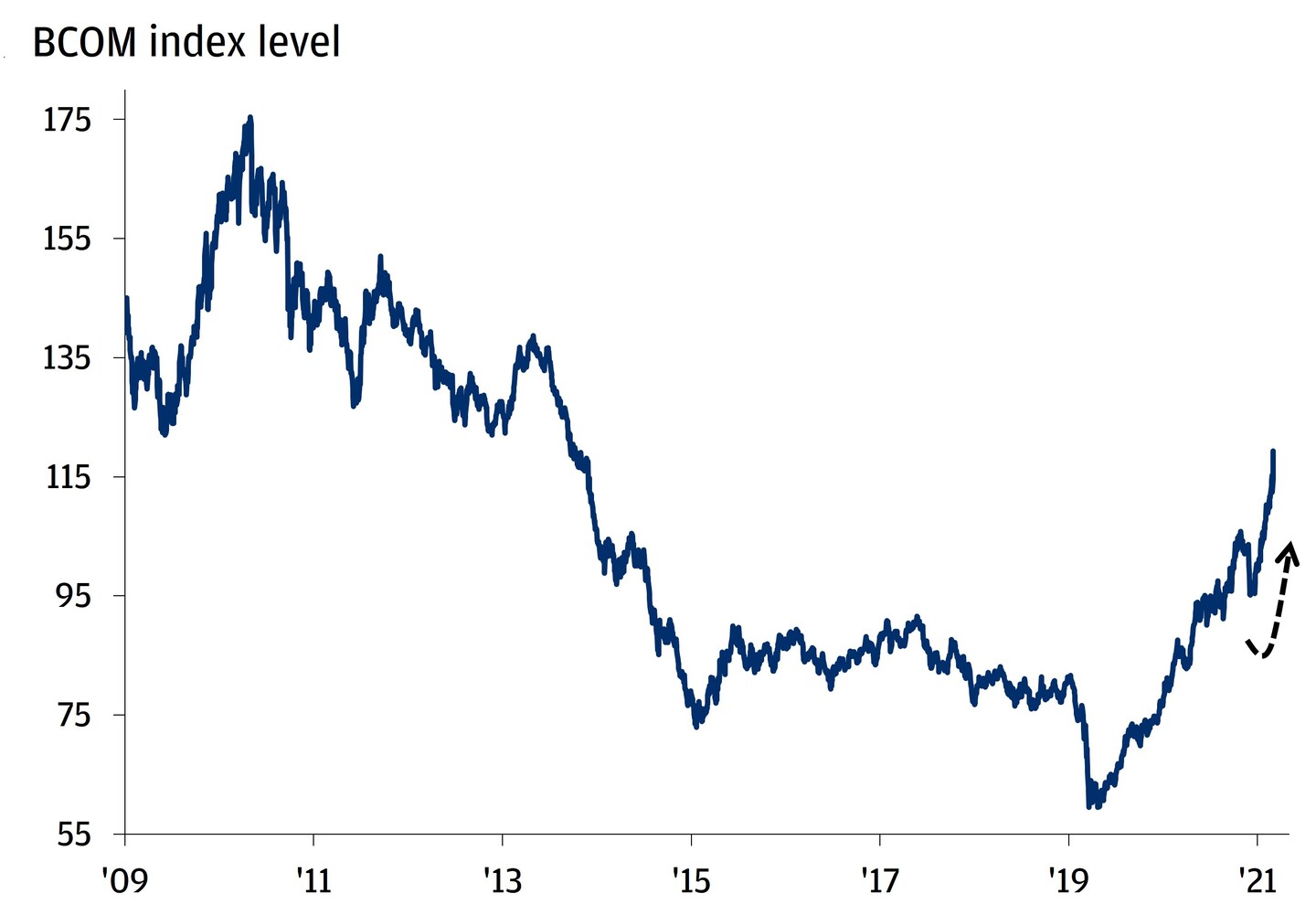

The Bloomberg commodities index tracks prices of a basket of commodities (think of oil, natural gas, corn, wheat, copper, gold, and so forth). And, lately, prices have been soaring. Let’s break it down.

Russia produces ~12% of the world’s oil and ~17% of natural gas, while Ukraine exports ~13% of global corn and ~12% of wheat. Since the start of last week, prices skyrocketed. Oil prices, for instance, rallied and WTI is now trading above $111/barrel for the first time since 2011 and the Bloomberg Commodity Index had its largest rally since 2009 yesterday.

So, what’s the issue with higher prices? Well, 40% of Europe’s natural gas and 27% of its oil comes from Russia, and 30% of that energy is transported through Ukrainian territory. The United States, on the other hand, imports just 1%-3% of its oil and gas from Russia. Thus, it seems like higher energy prices will be harder on Europeans than they will be on Americans.

High energy prices could keep inflation high, making it even harder for central banks as they seek to promote economic growth.

COMMODITIES CONTINUE THEIR CLIMB

All market data from Bloomberg Finance L.P., 3/2/22.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.