Top Market Takeaways Quick shot: Too much of a good thing?

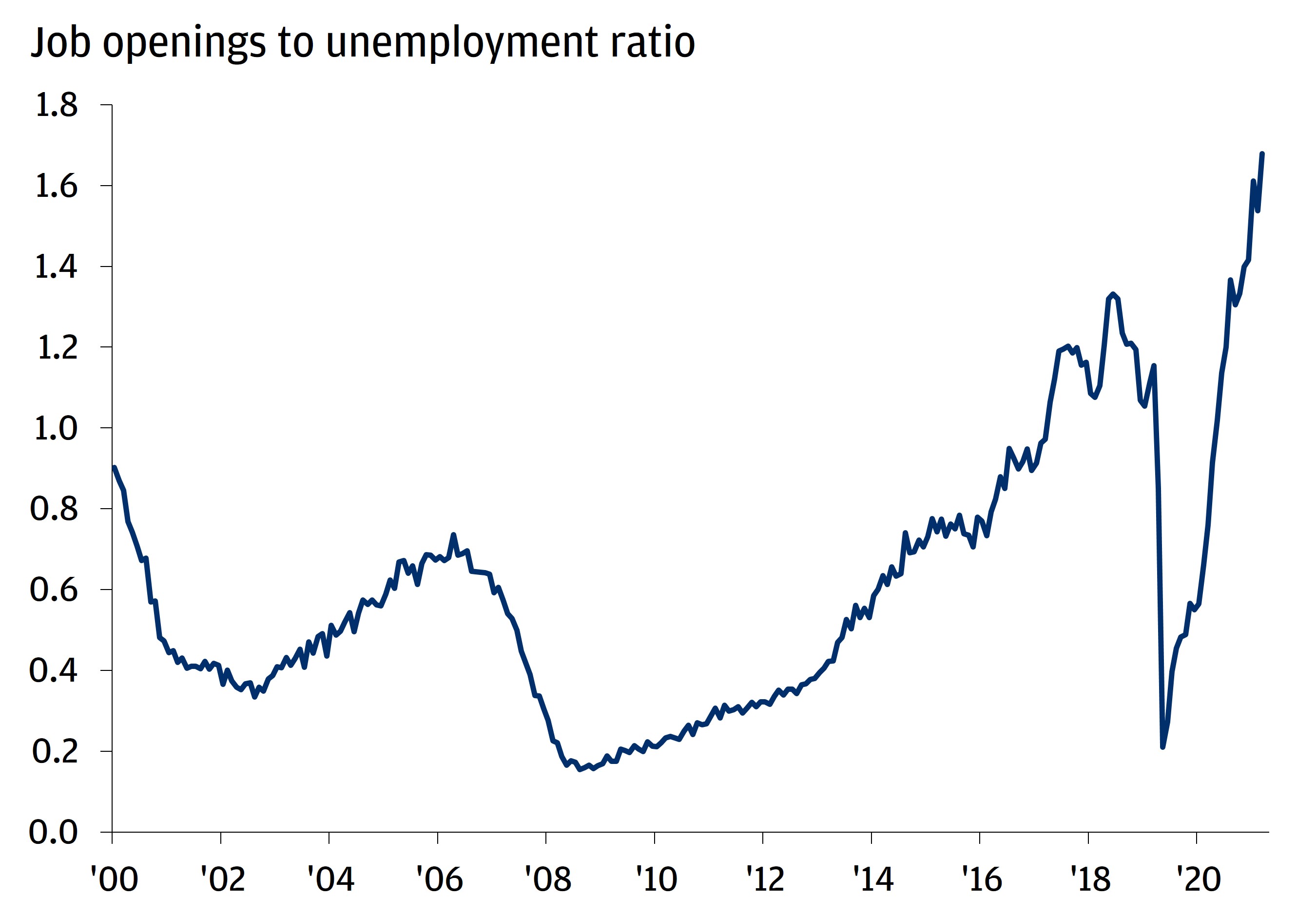

The job openings to unemployment ratio – or, the number of jobs available per every person looking for one – was in sharp focus during the Fed’s March meeting press conference yesterday. With close to two jobs available for every unemployed worker, Fed chair Powell described the measure as being at an “unhealthy level.”

Okay, there are 1.7 job openings for every unemployed person. On one hand, lots of job openings sound like a good thing: theoretically, anyone who is seeking a job can find one. But on the other, it means that workers have an edge in being able to demand higher pay to take the job. Wage growth sounds like a good thing too, but Powell’s concern is that current levels are going to create too much of a good thing: higher wages feed through to higher inflation throughout the economy, since they increase the cost of doing business.

So, the Fed has decided it’s time to start doing its part to slow economic activity down in an effort to control inflation. The jobs market (and the economy at large) seem healthy enough to absorb tighter monetary policy. Looking ahead, we think the result will be slower growth and slower inflation versus last year’s breathtaking paces – a more steady, “normal” type of economic expansion.

THERE ARE 1.7 JOB OPENINGS FOR EVERY UNEMPLOYED PERSON

All market data from Bloomberg Finance L.P., 3/17/22.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.