Top Market Takeaways Quick shot: How you doin'?

Banks, margins and the consumer: We think these are the three key things to monitor throughout the second quarter earnings season.

While we don’t see the banks as in the hot seat like they were in the first quarter of this year, we do think of them as a sort of bellwether for the economy as they provide insight into the consumer and credit conditions. Credit is like oxygen for the economy, and right now the Fed is trying to slow the amount of oxygen in order to cool the still-burning fire of inflation. Bright side, the U.S. is trending closer to the Fed’s 2% inflation target as of the most recent Consumer Price Index (CPI) from June which came in at 3%.

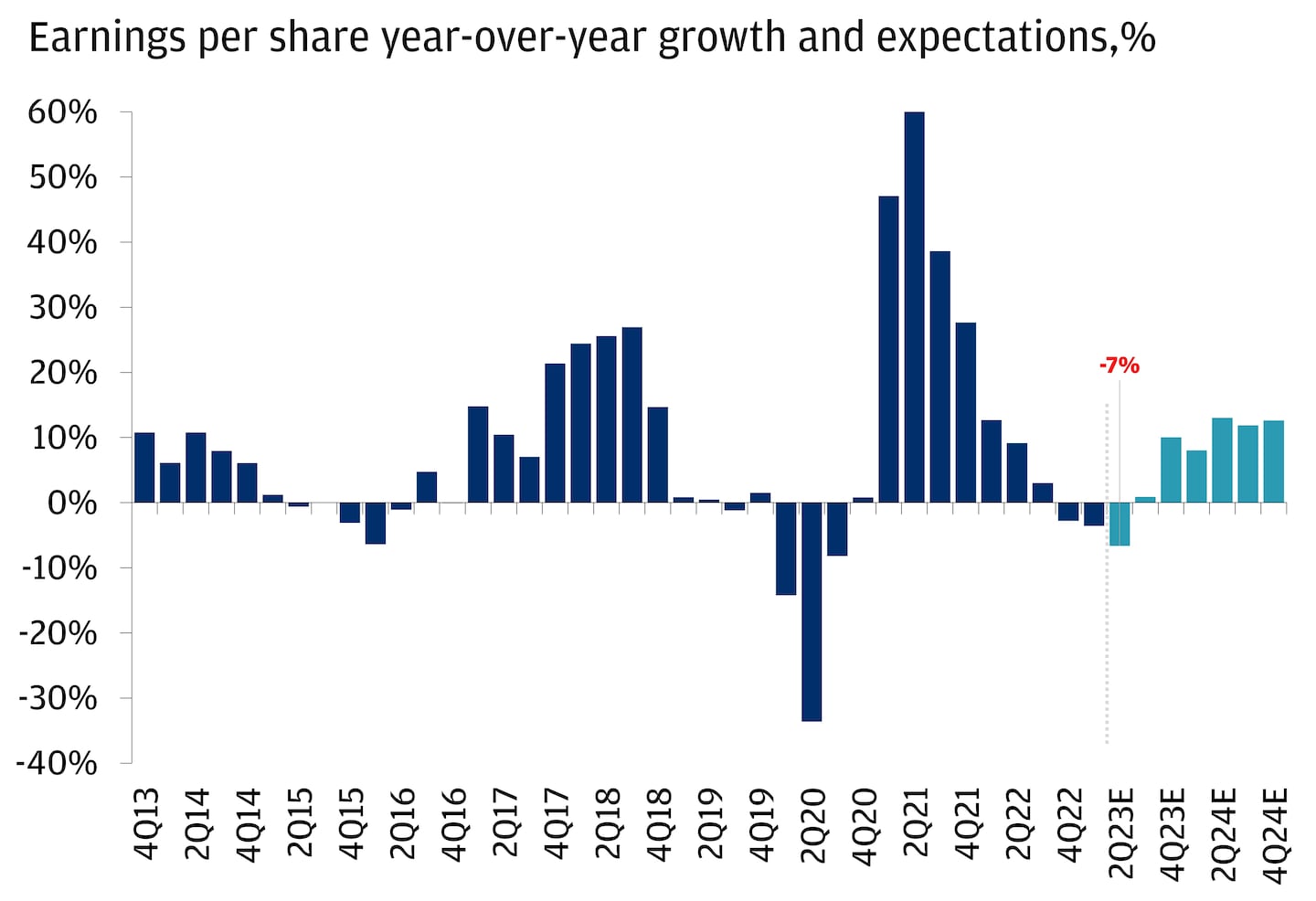

Now, how about them margins? Well, margins help investors assess profitability. Said differently, they help us understand how companies are managing revenues versus costs. Broad market consensus is for Q2 earnings to contract by roughly -7% from the prior year. While we expect earnings to be down this quarter, we believe that margins will hold up better than expectations, propelled by prudent expense discipline and pricing power from various companies.

As for the consumer? This is a consumer-driven economy. Consumer spending makes up about 70% of U.S. Gross Domestic Product (GDP). During earnings season, corporate CEOs host earnings calls and provide forward guidance on the coming 12 months. These calls can help investors understand how the business world is viewing the strength of the consumer. A consensus that the consumer is strong or a positive outlook on the economy may mean that growth is on the horizon.

The market seems high on optimism lately, but earnings are still expected to have contracted in the second quarter. We’ll be watching carefully as the earnings season unfolds but believe the upbeat nature in markets may be warranted – we think the results could surprise to the upside.

Markets expect a Q2 contraction but growth ahead

All market data from Bloomberg Finance L.P., 7/13/23.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Ajene Oden

Global Investment Strategist

Global Investment Strategist

AJ Oden is a Global Investment Strategist for J.P. Morgan’s Global Investment Strategy team. AJ, in partnership with asset class leaders and the Chief Investment Officer and team, is responsible for developing and communicating the firm’ ...More