Top Market Takeaways There’s been a stock market sell-off—now what?

Market update: A rough start to the year

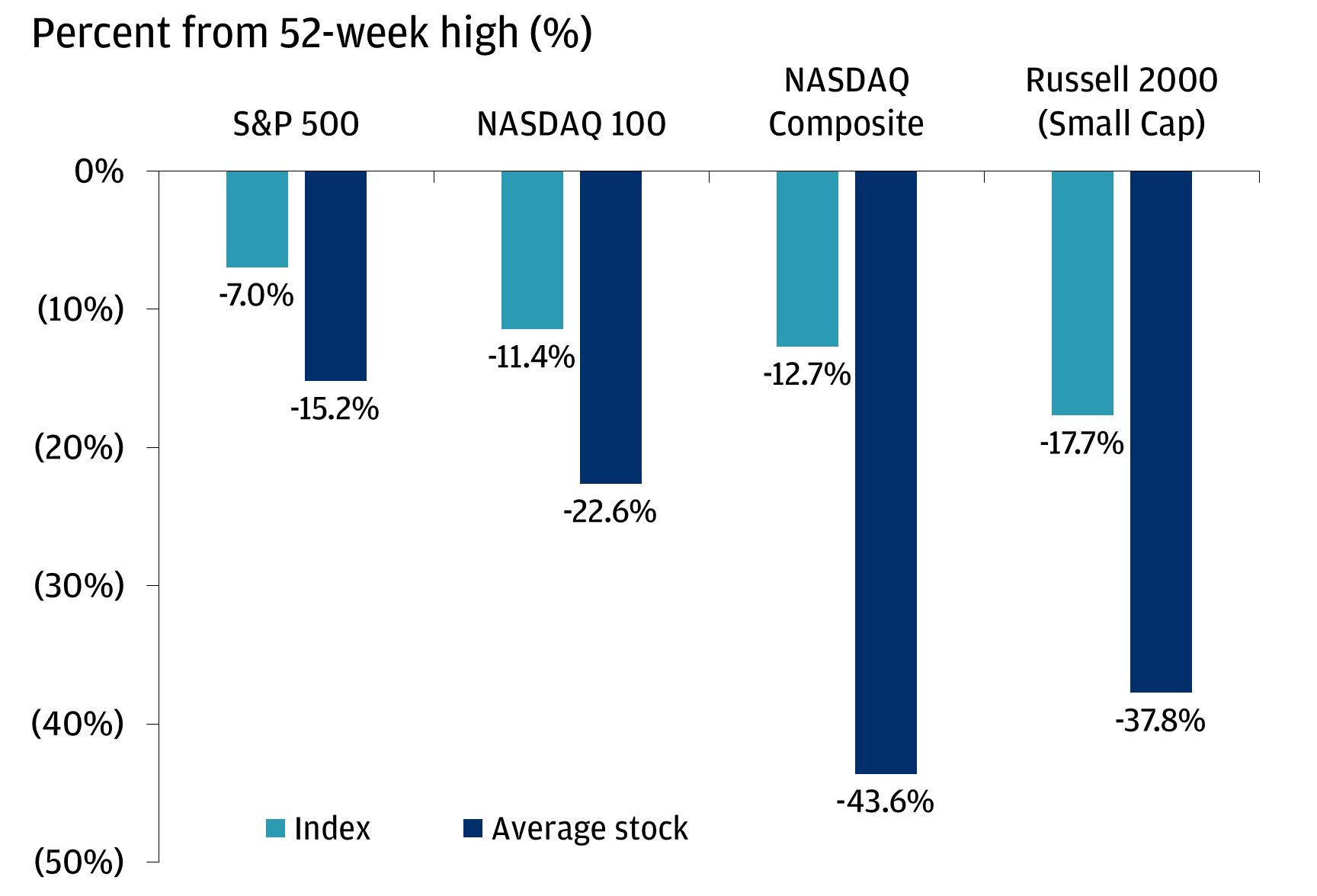

Rough start to the year for markets. The S&P 500 lost another -1.9% so far this week, which means the index is now -7.0% lower than its record set earlier this month. The NASDAQ 100 is in correction territory: -11.4% lower from its last all-time high.

We talked about why the sell-off was happening last week. In short, the prospect of a Fed that is focused on fighting inflation by raising interest rates and reducing the size of its balance sheet is tough for the market to digest.

While the headline indices are under pressure, they have notably held up much better than the average stock inside the index. For example, while the S&P 500 is down 7.0% from its all-time high, the average stock within the index is down over 15%!

It serves as a reminder of a classic investing adage: It’s not a stock market, it’s a market of stocks. Point being: If you don’t look underneath the surface, you can miss a lot about the dynamics that are driving the indices one way or the other. Another key takeaway: Diversification is your friend when volatility is elevated.

REMEMBER, IT’S A “MARKET OF STOCKS”

So the stock market has been under pressure. How can you, an investor, manage your way through the rut while sticking to your plan and achieving your financial goals? We like to stick to these three simple rules.

Spotlight: How to navigate a stock market sell-off

Remember that stock market sell-offs are normal. Are you familiar with the concept of risk and return? The saying (and the math) suggest that if you don’t take much risk, you shouldn’t expect much return.

Stocks are inherently risky because when you buy equity in a business, you are providing it with capital that it will hopefully use to expand capacity, develop a disruptive product or make a transformative acquisition that generates solid earnings over the long term that you, an investor, are entitled to.

The risk is that the business may not ever pay you back (e.g., because it goes bankrupt), or may not pay you back as much as you assumed it would (e.g., because its product becomes obsolete).

Investors use stocks in portfolios to generate returns. Sometimes, though, the future earnings of the companies get called into question (e.g., because economic growth may slow), or the marketplace doesn’t think the future expected earnings are worth as much as they may have been a week or month ago (e.g., because interest rates may have risen).

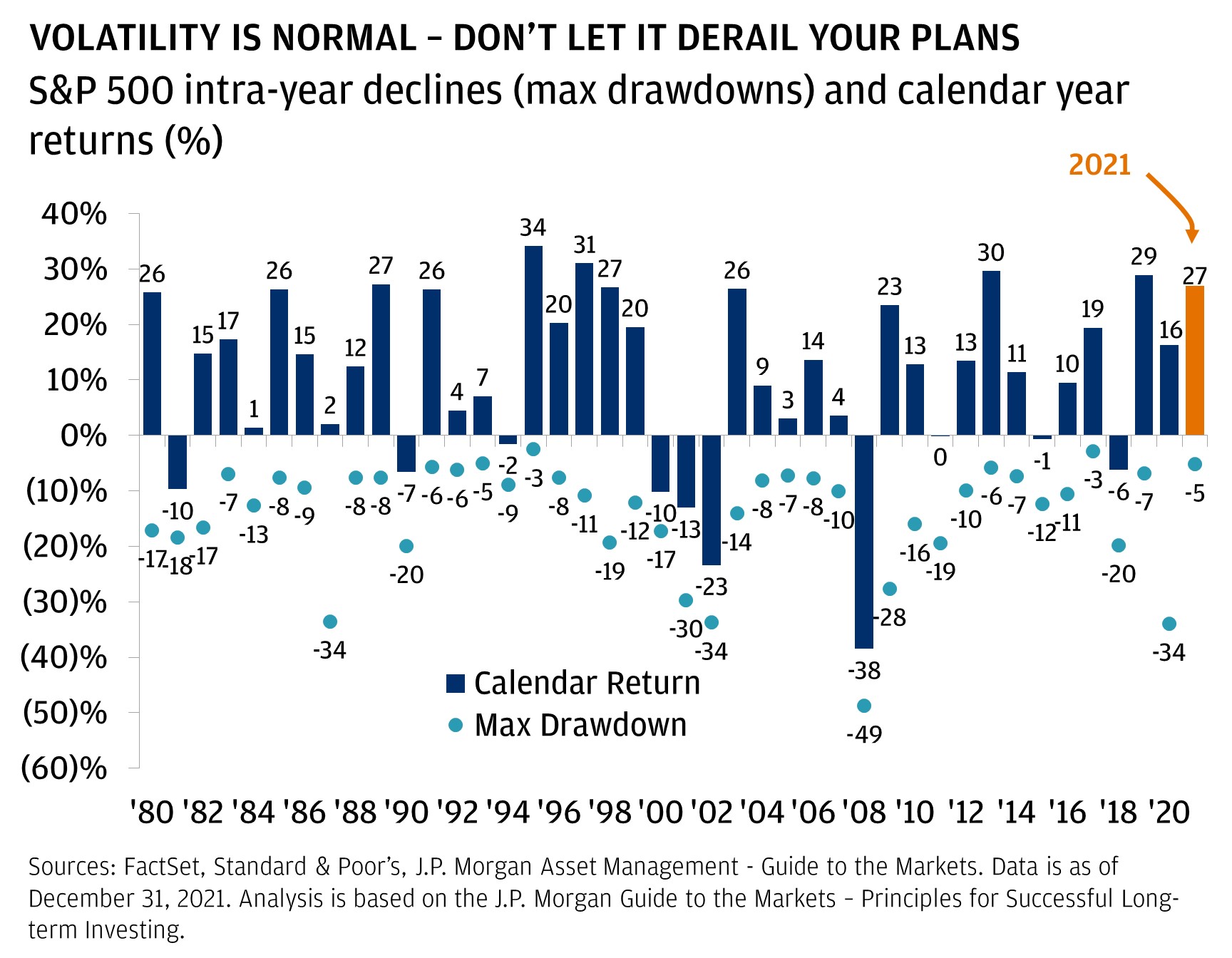

This leads to stock market sell-offs that are larger, and happen with more frequency, than you might think.

This particular ~5% sell-off in the S&P 500 is the 27th one since March 2009. Looking back at the average calendar year (back to 1980), the S&P 500 has experienced a 14% peak-to-trough decline. Despite these sell-offs, the annual return of the index was positive in 31 out of 41 years. Notably, last year was quite abnormal in that the largest peak-to-trough sell-off was only -5%. This year may end up being much closer to average.

VOLATILITY IS NORMAL – DON’T LET IT DERAIL YOUR PLANS

Understand why the sell-off is happening. Understanding why a sell-off is happening can help an investor decide if the turbulence is part of the “normal” course of investing or whether it is a sign of a bigger impending drawdown.

In this particular sell-off, we think a few factors are driving the weakness. The main one, in our eyes, is that the Federal Reserve has taken a much more aggressive stance toward fighting inflation. Investors are now expecting at least four 25 basis point interest rate hikes this year, which has sent interest rates across maturities materially higher than they were at the beginning of the year.

IMPENDING RATE HIKES AND RISING YIELDS ARE THREATENING THE EQUITY MARKET

Stocks are getting hit by this for two reasons. First, the rate at which investors discount future cash flows is higher, which brings down the current valuation of companies. Second, higher rates usually mean slower economic and earnings growth in the future, which can hurt stock prices now.

As we discussed in detail last week, we don’t think this particular sell-off is the first stage of a material drawdown. Stocks have exhibited some turbulence in the months around “lift-off,” but they tend to find their footing once they adjust to higher policy rates. In the last six hiking cycles, which lasted 18 months on average, the average S&P 500 return was over 13%.

Rates are rising, and fast, but equities tend to rally during rate hiking cycles because they tend to happen when the economy is strong. We don’t see a compelling reason why this time would be different.

Think about your goals, and some potential changes

If you agree that this sell-off is “normal” and not the harbinger of a bear market, the next step is to ask if your financial goals have changed. If so, then it probably makes sense to consider holistic changes to your investment portfolio. If not, then big changes probably aren’t necessary, but tweaks to portfolios could be helpful.

Here are two changes that we have made in portfolios that we think can help in the environment emerging over the next several months.

- Focus on quality across sectors. The types of companies that have suffered the most during this bout of weakness are ones that don’t have any profits now but could have rapid growth and huge profits in the future. A basket of unprofitable tech/tech adjacent companies is down over 17% so far this year, much worse than the market as a whole. Focusing on profitability should be increasingly valuable as interest rates continue to rise. Further, balancing between characteristics is also important. There is more to the market than just technology. Owning companies that are linked to the real economy (in areas like finance, industrials, and pockets of energy) probably makes sense in a strong growth environment.

- Check in on fixed income portfolios. It usually doesn’t make sense to invest too heavily in fixed income in a high inflation, rising rate environment. However, now might be the time to start getting familiar with the asset class again. Now that the market has raised its expectations for interest rate hikes, front end yields look more attractive and active managers can pull various levers to help outperform cash. It also probably makes sense to think about methodically closing underweights to core bonds as 10-year treasury yields start to move towards 2%. We aren’t quite there yet, but given the way this year is going, it makes sense to be ready.

To hear more about what we think of this equity market sell-off, and how you can navigate it, please reach out to your JPMorgan Advisor.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

All market data from Bloomberg Finance L.P., 1/20/22.