Top Market Takeaways 3 election year myths debunked

As if it wasn’t busy enough, 2024 is the year of elections.

Over 40% of the world’s population and economy will hit the polls to elect national leaders, starting with Taiwan last weekend and culminating with the United States in November. This past week’s Iowa caucus already kicked off U.S. primary season, and New Hampshire follows next week. Election debate will only ramp up from here.

Right now, it’s looking like another Biden versus Trump standoff – at least according to prediction markets, favorability polls and most political pundits. That said, 10 months is a long time in politics. Much could change, and the lead-up to Election Day can stir up emotions and apprehension about the future.

Today, we debunk three common election myths when it comes to markets.

Myth 1: Stocks don’t do well in election years

Reality: Returns in election and non-election years usually aren’t all that different.

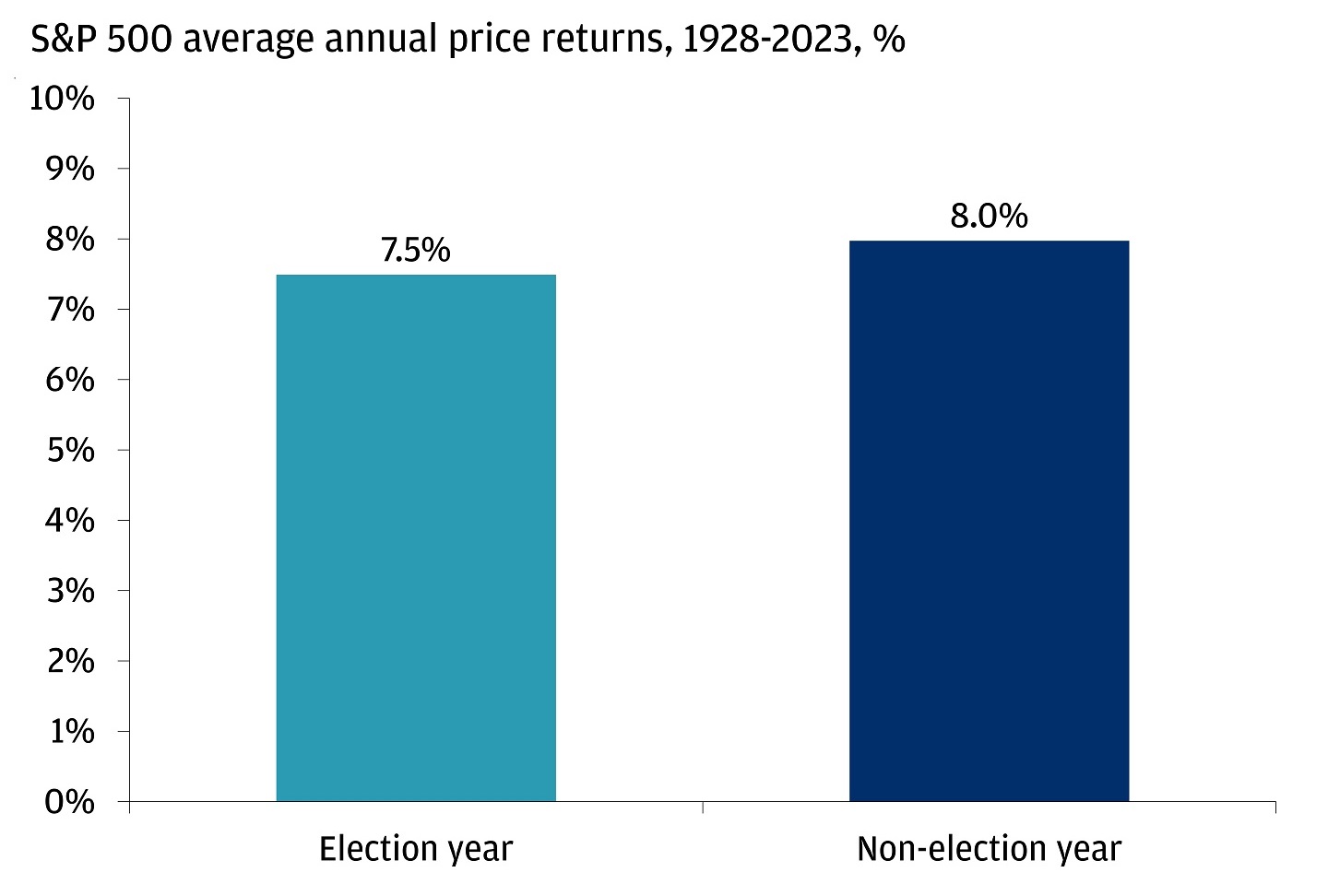

We took a look at how the S&P 500 has fared in both instances. Going back to 1928 (for as long as we have data), stocks returned 7.5% on average during election years, compared with 8% during non-election years. Slightly weaker but still solid.

Stock returns don’t tend to differ much in election years

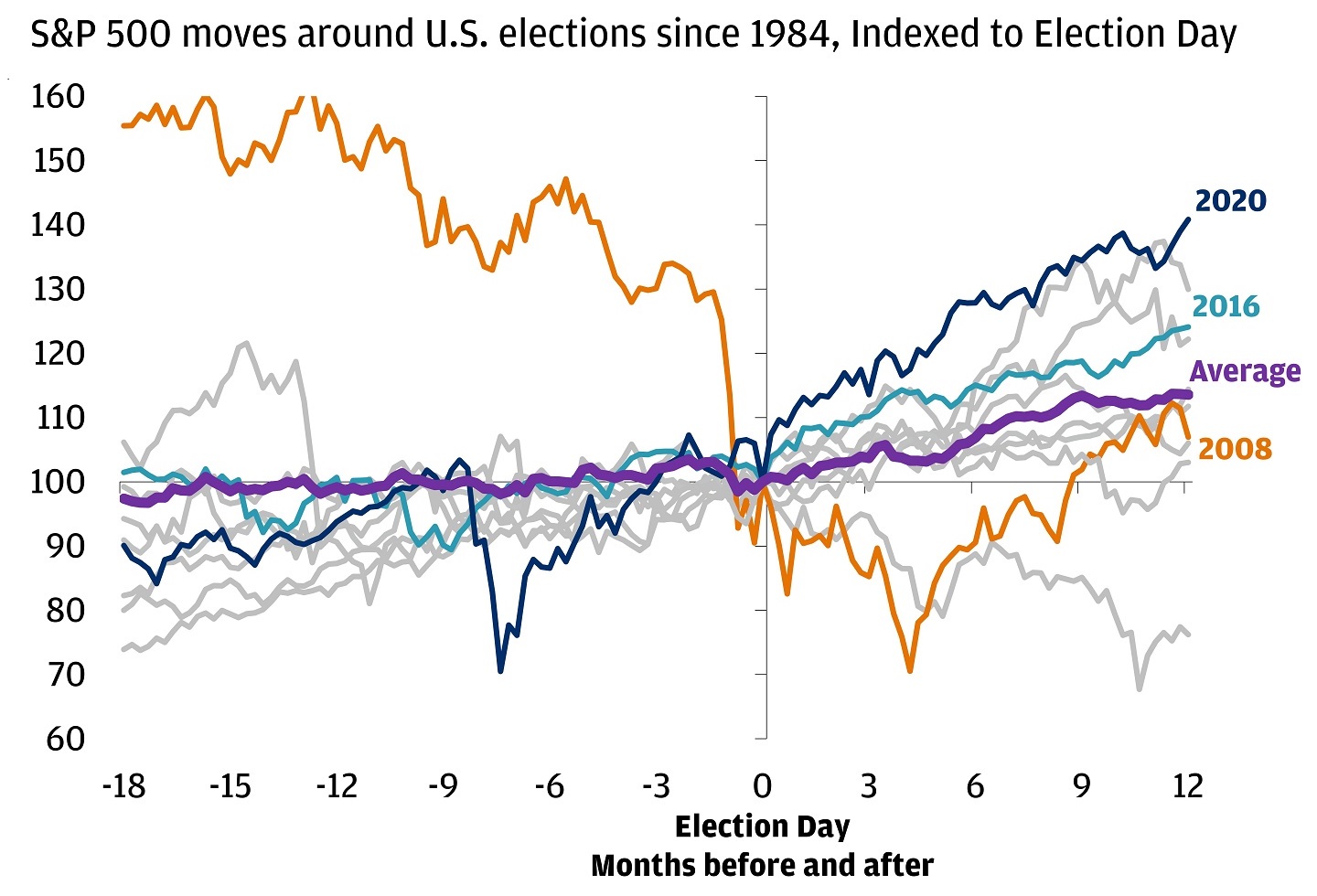

That said, election years do tend to be more volatile than most, especially in the lead-up to voting day. For instance, the average election year since 1980 has seen an intra-year drawdown of about 17% versus 13% in non-election years. Volatility is a feature, not a bug, of investing in any year, but it tends to be more pronounced as households grapple with more uncertainty.

Yet as that uncertainty dissipates as results are announced, stocks tend to rally on a sense of clarity about the path forward.

Myth 2: Markets will crash if so and so candidate wins

Reality: We’ve seen booms and busts on both sides of the aisle. The economic backdrop tends to matter more.

While stocks tend to rally in elections’ aftermaths, it’s true that some election years have seen bigger swings than others. But those instances have tended to do more with the underlying macroeconomic backdrop than the election itself.

For instance, in the last presidential election in 2020, it was the tides of lockdown and reopening from the COVID-19 pandemic that impacted broad markets most, rather than the differing ideologies between now-President Biden and then-President Trump. Or consider 2008 when Democrat Barack Obama ran against Republican John McCain: The unfolding Global Financial Crisis was the predominant driver, rather than opposing candidate views on the war in Iraq and health care policy.

With that, and the last 40 years of elections in hand, stocks have still been higher a year later on average.

Election jitters? Markets tend to rally as uncertainty fades

Myth 3: The Federal Reserve doesn’t change policy in election years

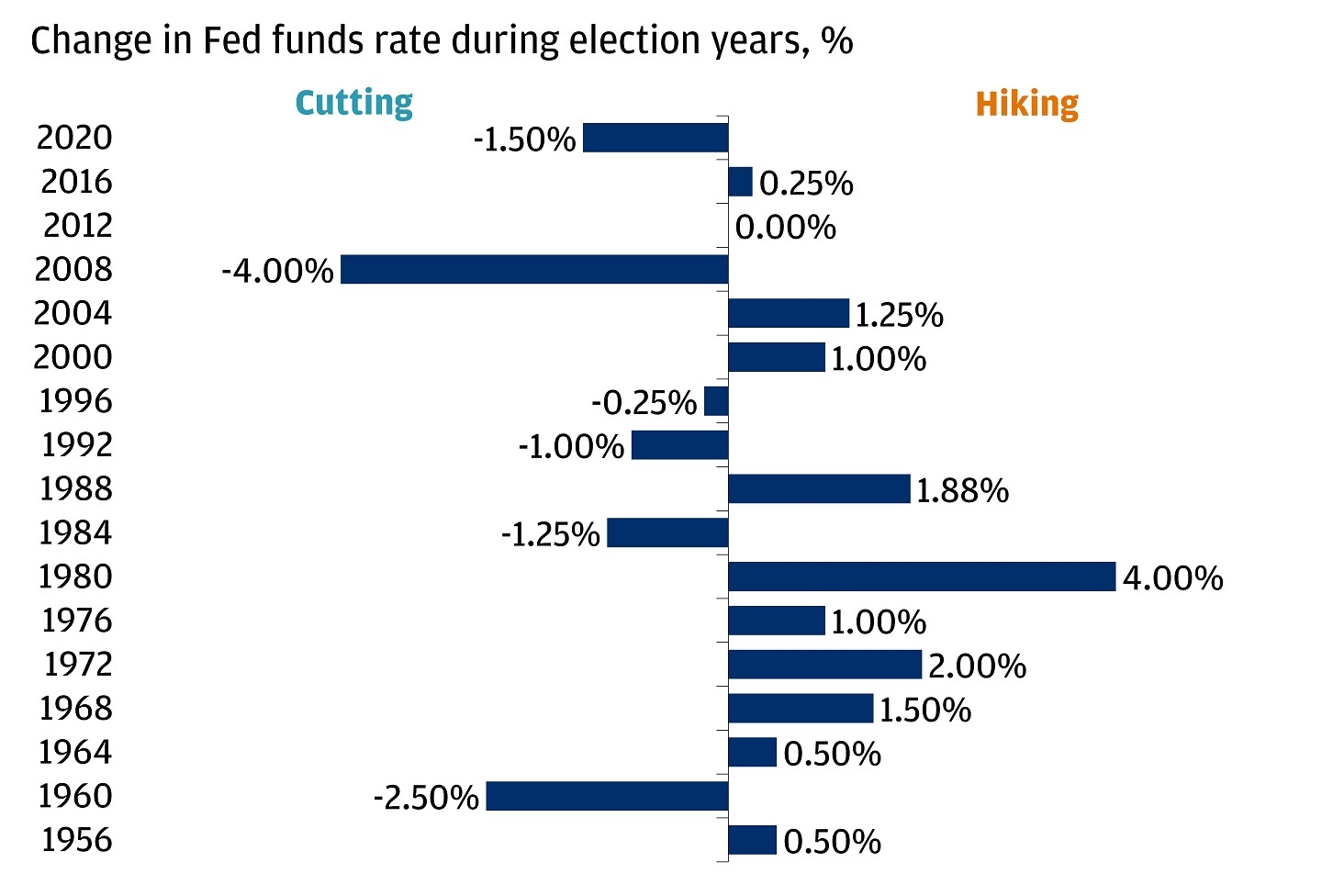

Reality: The Fed hasn’t shied away from hiking or cutting rates during election years.

Going back to the 1950s, 2012 has been the only election year that the Fed did not either raise or lower interest rates. Similar to myth #2, this suggests that the economy, rather than politics, is in the driver’s seat when it comes to monetary policy. We believe that this year will be no different.

The Fed has still made moves in election years

The Fed’s big focus today is how to softly land the economy, and it’s no small task. The pivot toward rate cuts requires careful navigation, ensuring inflation makes the last mile of progress and that growth doesn’t tip into recession.

That said, once the election results are in, the new administration’s policy proposals could shift expectations for growth, inflation and even earnings. Some could also impact individual sectors that are most closely linked. But at this point in the race, it’s still too early to outline those potential impacts, and it’s also important to note that not all policy proposals go through. High-impact proposals seem more likely to be adopted only if one party controls the White House and Congress, and even then, policymakers are often confronted with challenges and bottlenecks.

As the election chatter builds, we expect some of the hot button issues to include government spending and the deficit, tax policy, regulation, trade and geopolitics.

How can you plan for the year ahead?

While politics can evoke strong emotions, we don’t think one should lose sight of their long-term investment goals. We believe the economy will remain the predominant driver of policy decisions and markets broadly.

Of course, there are risks, from ongoing friction points such as inflation to wildcards such as geopolitics. But we believe that as growth holds up, price pressures abate, and the Fed embarks on an easing path, there is ample opportunity for multi-asset investors in the year ahead.

Your J.P. Morgan team is here to help you navigate the shifting landscape and create a portfolio that is built to last, whether it be through business cycles or elections.

All market and economic data as of 01/19/2024 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.