Investment strategy Small business owner? Ways to consider investing through year-end 2023

Photo courtesy of Adam Hoff.

2022 was a volatile year for markets, with the word “recession” on the tip of many economists’ tongues. Then Q1 2023 saw multiple well-publicized bank failures and bailouts. The banking issue fortunately proved to be contained. In the following months, equity markets have rallied, with the S&P 500 up more than +17% year-to-date. The June Consumer Price Index (CPI) print showed headline inflation falling over 100 basis points year-over-year. To boot, core inflation fell to 4.8% – its lowest since 2021. But markets are not the economy, and core inflation, which is closely tied to the resilient labor market, is still not low enough.

All this considered – is a recession still expected? And if so, what are wise moves forward?

These questions are on the minds of many investors. At our J.P. Morgan Wealth Management event in Pasadena, California, we addressed them through the lens of small business owners, who carry a unique set of investing needs, concerns and long-term goals. Moderated by Brian Blagdon, a J.P. Morgan Wealth Management Investment Product Specialist, the event featured Ajene Oden and Jason Whong – J.P. Morgan Global Investment Strategist and J.P. Morgan Wealth Management Wealth Advisor, respectively. Read on for their take on what we might expect through year-end 2023 and how business owners can consider positioning their portfolios to thrive.

How are markets looking now?

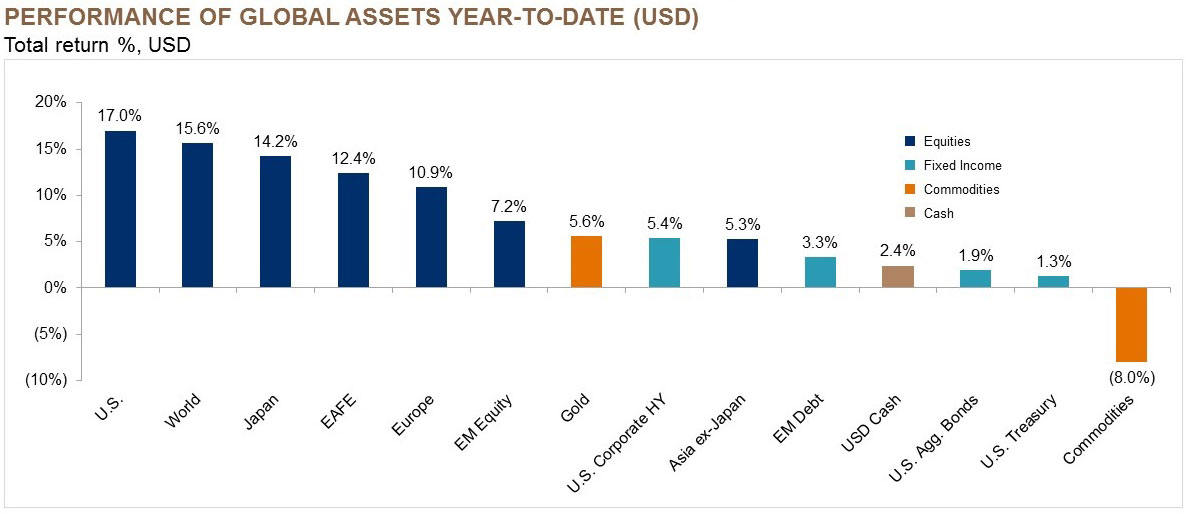

2023 markets have been performing well. The U.S. has led the world in equity returns, and fixed income has also proven strong.

Markets are having a strong start to the year

Equities have led the way; bonds are once again providing valuable protection

“But the Fed is still focusing on the labor market and inflation,” Oden said.

In response to the Q1 bank turmoil, bank credit conditions tightened. Similar to the Fed raising interest rates, tighter credit conditions are a way to slow the economy to cool inflation. When banks make it harder to take out a loan, consumers and small businesses have less capital to spend, which should in theory dampen inflation by slowing the economy.

How can your business work around the tighter credit market?

Leveraging borrowed capital is a key component in many growing – and successful – businesses. Considering tighter credit conditions, bank financing may be a less attractive and available option right now, with private credit being more appealing.

“Leveraging has existed in business forever,” Whong said, “With the lack of public funding, we’re finding a lot of private credit sources providing capital for inventory, expansion and a number of other activities. So there are gaps being filled by private capital. It’s a little more expensive – might be a little more difficult to find – but it’s out there. And we’re seeing it being utilized more and more, and that’s a good sign.”

What about rate hikes?

“The past year was one of the most aggressive Fed rate hiking cycles in history,” Oden said. “We know that. But here’s the good news: it seems like we’re near the end of it.”

Okay so… is the U.S. heading into a recession? Or will the Fed achieve a soft landing?

“People often think of the path to a recession as a roadmap with phases,” Oden said. “Phase one is often interest rate sensitive sectors deteriorating. Phase two is tightening credit conditions. Phase three is earnings contraction. And that’s where we are right now. The next phase is typically companies trying to defend those margins through layoffs. The labor market is still tight, so we haven’t seen that yet. But if that happens, that’s probably going to be the shoe that drops to ultimately declare a recession.”

A year-end 2023 recession seems likely. But so does the probability of earnings bouncing back in 2024.

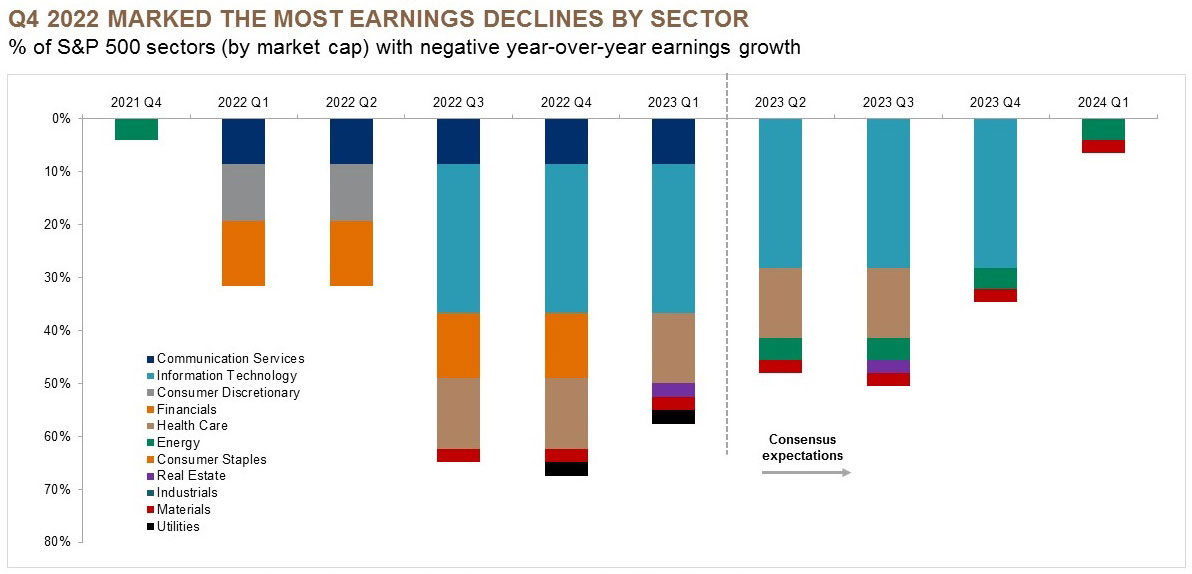

We think the worst of the earnings recession is behind us

Different sectors have been correcting at different times

Q4 2022 marked the most earnings declines by sector.

In comparison, Oden said, “Only two sectors are expected to lag in Q1 2024. Not the other nine. We expect that stock rallies will probably broaden.”

Despite an expected recession, the prospect of profits rising in Q1 2024 makes investing now a potentially beneficial move.

How should small business owners approach their investments?

In both good times and bad, a common question business owners ask is: If I have excess cash, should I invest it back into my business or expand my investment portfolio?

“Our research indicates that many business owners have more than 80% of their cash and assets in their business,” Whong said. “This poses concentration risks. It may be better to take some of your wealth out of your business and diversify it.”

From now through 2024, business owners may do well to expand their portfolios, particularly with a view on:

- Investment grade core bonds, which offer added defense.

- Building portfolios for the next bull market through mid cap equities, which have historically outperformed large cap equities in the first year of recovery.1

- International markets, which offer diversification for a more robust portfolio.

What if your investments are heavily weighted in publicly traded stocks?

For clients whose investments are heavily weighted in publicly traded stocks and are looking to expand their portfolio exposure, some strategies that can help reduce concentration risk without triggering capital gains are: securities based lending, exchange funds, variable prepaid forward contracts and charitable trusts.

Next steps

Small businesses are integral to the health of the U.S. economy. Regardless of market moves, it’s wise to invest with intention and a long-term mindset. Speaking with a J.P. Morgan advisor can help you navigate volatility and stay invested through your long-term goals. Get connected today.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Mary Mannion

Editorial staff, J.P. Morgan Wealth Management

Editorial staff, J.P. Morgan Wealth Management

Mary Mannion is a member of the J.P. Morgan Wealth Management editorial staff. Previously, she was an Analyst within the firm, where she worked in both Asset & Wealth Management and the Consumer & Community Bank. Mary graduated w ...More

Footnotes

-

1

Bloomberg Finance L.P., J.P. Morgan Global Wealth Management. Note: Recessions determined by NBER. Recovery begins at the trough of the respective indices. Mid caps represented by the S&P 400 Index and large caps by the S&P 400. Data as of December 30, 2022.