Investment strategy Why you shouldn’t “sell in May and go away” this year

- The saying “sell in May and go away” refers to liquidating all positions while you vacation in the summer and is based on the historical underperformance of some stocks in the summer months.

- Despite the saying, this year may be different than most, as the economy is poised to reopen and recover.

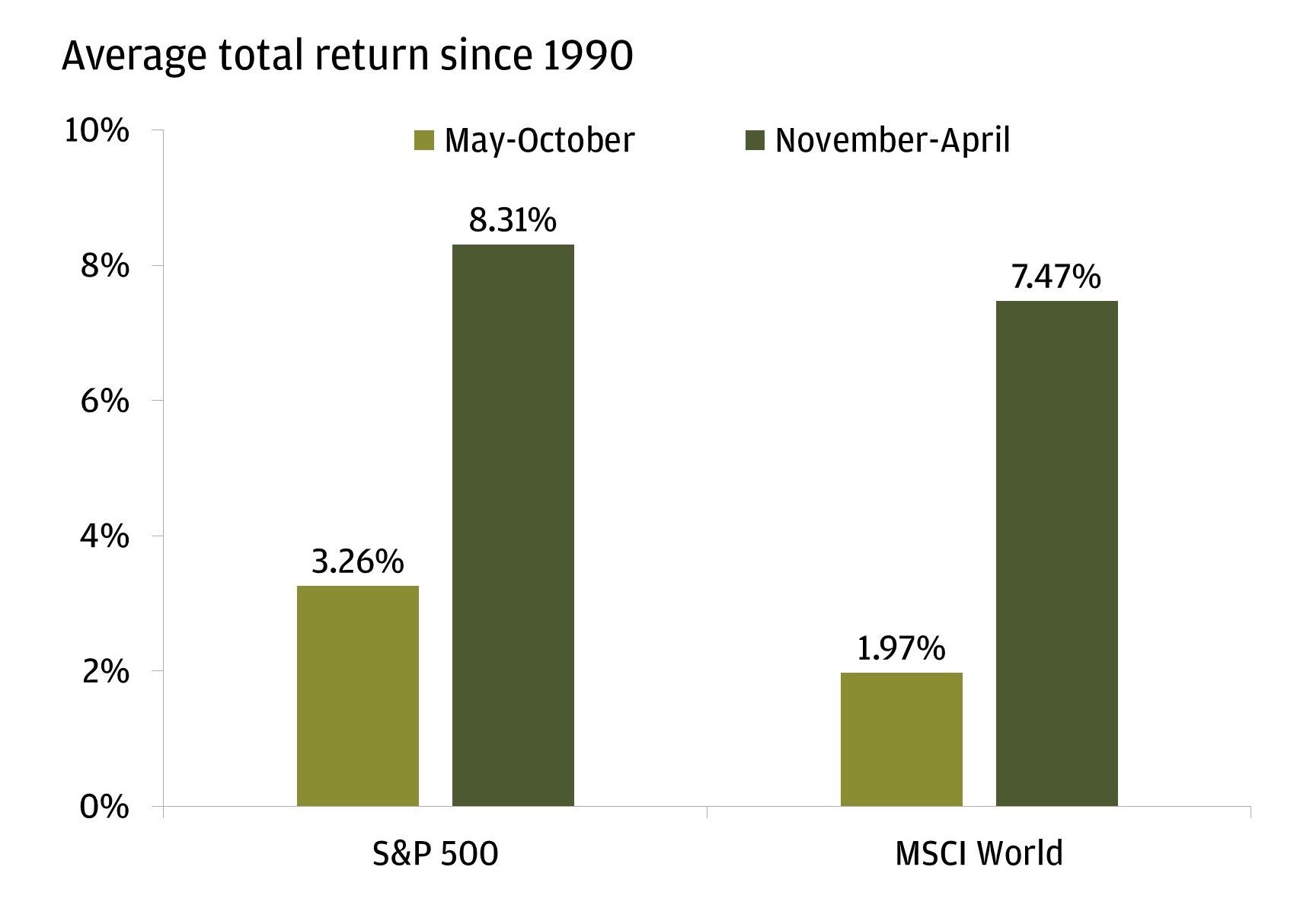

- Even though historical stock market returns tend to be stronger from November through April, the difference isn’t as much as you may think.

If you were thinking of following the old market adage “Sell in May and go away,” you might want to reconsider.

The saying, which hints toward liquidating all positions while you vacation in the summer, is based on the historical underperformance of some stocks in the six-month period between May and October, compared to the winter months between November and April. Those who follow the strategy believe that low volumes and the lack of market participants in the summer could create a riskier – or uneventful – market period.

Average returns are better from November through April versus May through October

However, the summer months of 2021 should be anything but lacklustre. The historically weak seasonal stock market performance may be overruled by the gains driven by the economic reopening, prompted by federal stimulus, the Federal Reserve’s easy money policy, rising vaccination rates, falling COVID-19 cases, and rising Treasury yields.

Shawn Quigg, an executive director at JPMorgan Chase, said the reflation and reopening trade could continue into late spring and summer, catalyzing a rotation from growth, quality, and defensive stocks into value and cyclical stocks.

Moreover, analysts expect companies to report strong second quarter earnings results starting in July, which is set to push stock prices even higher during the summer months.

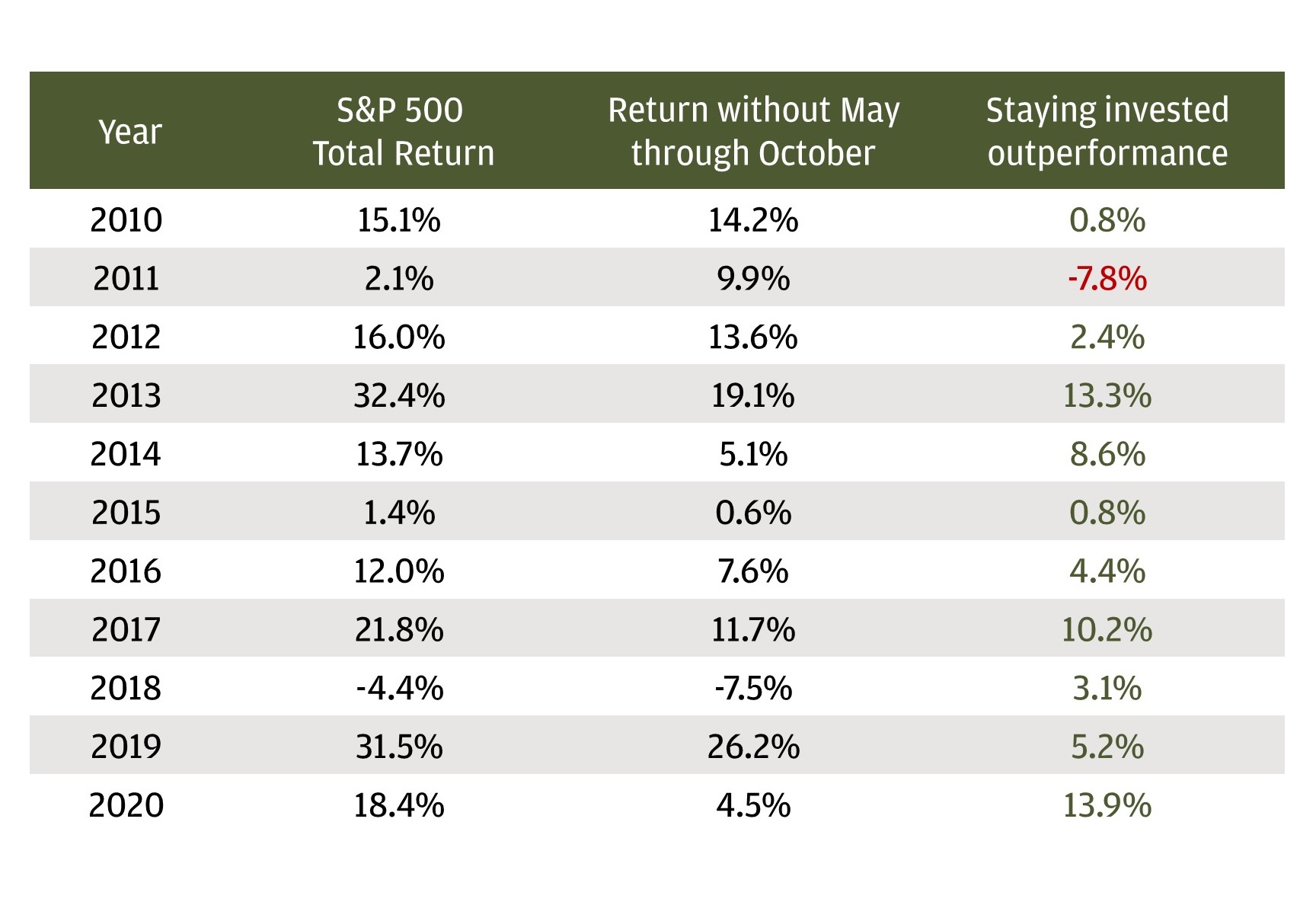

Interestingly, even though historical stock market returns tend to be stronger from November through April, the difference isn’t as much as you may think. In the past decade, 2011 was the only year in which divesting from the S&P 500 from May through October left you in a better position than if you had stayed invested.

Over the past decade, the only year in which “selling in May and going away” benefitted an investor was 2011

An alternative strategy to selling in May is rotation, whereby you vary your portfolio and focus on stocks that might be less affected by the seasonal slowdown in the markets, such as technology or health.

However, for most investors with long-term goals, keeping your equities yearlong is likely the best move. Not to mention the potential tax consequences it saves you from; selling stocks every April 30 may force you to pay short-term capital gains taxes that can eat away at whatever occasional benefit you might gain from “selling in May and going away.”

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Elana Duré

Editorial staff, J.P. Morgan Wealth Management

Editorial staff, J.P. Morgan Wealth Management

Elana Duré, is a member of the J.P. Morgan Wealth Management editorial staff. She was a markets writer for Investopedia prior to joining J.P. Morgan Wealth Management. At Investopedia, she covered finance and business news for the websit ...More